What to Know | Religious Organizations and Matching Gifts

Religiously affiliated fundraisers like yourself are constantly on the lookout for new sources of revenue to better support their missions. One such opportunity is with corporate matching gift programs. Yet there tends to be a bit of nuance when it comes to religious organizations and matching gifts, and leaders of religious groups such as churches, synagogues, mosques, and other ministries often wonder if they’re eligible for the programs.

According to The Giving Institute’s Giving USA Special Report, religious giving is up substantially from 2016—with places of worship and faith-based orgs ranking in the top three types of charities supported by Gen Z, Millennial, Gen X, and Boomer donors alike. New technology simplifying the giving process, continuous industry developments, and more likely play a role in the growth. Now, how do matching gifts factor in?

We’ve put together this guide to help your team answer that question, specifically in regard to your own organization’s fundraising efforts. To better understand your faith-based nonprofit’s standing with corporate philanthropy, we’ll help you familiarize yourself with:

- Match eligibility for different types of religious organizations

- Typical wording from matching gift companies regarding religious orgs

- How Double the Donation’s matching gift software can help

When eligible, corporate matching gifts are an effective component of any organization’s overall fundraising strategy. These programs help amplify giving, empowering your team to do more with the funding you receive from generous supporters.

And the typical donor loves to get involved, too—seeing their impact stretch further than they may have thought possible.

If you’re ready to find out if your religious organization can benefit from matching gifts, let’s get started!

Match eligibility for different types of religious organizations

Unfortunately, strictly religious organizations are often excluded from companies’ employee matching gift programs. Still, it’s important to note that not all religiously affiliated nonprofits are treated the same under these employers’ matching gift guidelines.

Generally speaking, religious organizations are divided into two overarching categories when it comes to determining matching gift eligibility. These include the following.

Houses of Worship

Oftentimes, companies will not match donations to churches, synagogues, temples, mosques, and other places of worship.

If you run one of these types of organizations, you might be wondering why they wouldn’t qualify. After all, you know better than anyone the impact of effective fundraising for your cause.

However, places of worship are often considered religious institutions rather than charitable organizations. The primary difference generally lies in the idea that places of worship generally prioritize religious teachings and spiritual guidance to a specific group of members rather than serving the community in the way that nonprofits typically do.

Still, there are certainly some cases where the concepts overlap, which we’ll dive deeper into below.

Religious Organizations that Provide Social Services

This next category of religiously affiliated organizations is significantly more likely to qualify for matching gift programs—even if a donor’s company reportedly does not match donations to places of worship.

In fact, a common exception to the exclusion of religious causes will occur if the organization provides social services to the greater community.

Common examples may include:

- Food pantries

- Low-cost or free clothing banks

- Homeless shelters

- Disaster relief efforts

- Domestic violence support

- Youth programs

- Medical clinics

- Religiously affiliated educational institutions (preschool, K-12, and higher ed alike)

For these types of organizations to qualify for matching, there are generally a few stipulations in place. For instance, the company may verify that the initial donation and/or provided match is not being used for religious-specific purposes. Additionally, many employers require that the above types of social services be open to the general public and not involve any sort of religious teaching in order to remain eligible for the program.

If you come across a donor’s company that doesn’t match contributions to faith-based organizations, chances are, they may make exceptions for those that provide secular-focused services to the community.

Thus, make sure to read all the requirements instead of glancing over them. Otherwise, you may miss out on important revenue opportunities!

Typical wording from matching gift companies regarding religious orgs

While every employer’s matching gift criteria are different, participating businesses typically address the idea of religious organizations and matching gifts in their corporate giving program documentation. And companies can have vastly different stances on the eligibility of religious gifts.

Take these excerpts from several corporations’ matching gift forms, for example.

American Express

American Express matches donations to most 501(c)(3) organizations. In fact, the company will even match select donations at a 2:1 ratio if an employee also serves on the nonprofit’s board or volunteers for over 50 hours in a year. That means your donors who work for American Express can potentially triple their donations.

Here’s what American Express says about houses of worship and other religious groups in the company’s matching gift guidelines:

Gifts to houses of worship (churches, synagogues, etc.) will not be matched. However, the program will match a gift to an ongoing and independently-run program affiliated with a religious organization if the gift is restricted to a nonsectarian project that provides needed social services to the community at large on a non-discriminatory basis without any religious teaching, directive, or requirements to receive services (e.g., a soup kitchen, a homeless shelter, a food bank, etc.).

Read more about American Express’s matching gift program.

Campbell and Company

As a fundraising consulting firm, Campbell and Company understands the importance of corporate matching gifts for the nonprofits its employees support. Each year, full-time employees qualify to request up to $1,000 worth of matching gifts for their favorite charitable organizations.

According to their program policy, Campbell and Company takes the following approach to matching gifts made to religious groups:

Campbell and Company will only consider matching donations to religious organizations when the gift is designated to an ongoing secular, non-discriminatory community service program sponsored by these organizations which do not advocate or advance any specific religious views (e.g., a soup kitchen run by a church, a homeless shelter operated by Catholic Charities, etc.).

Read more about Campbell and Company’s matching gift program.

Castlelake

Matching donations to most 501(c)(3) nonprofits, Castlelake offers employee matching opportunities that amplify individual team members’ giving to schools, health and human services, arts and cultural organizations, civic and community organizations, environmental nonprofits, and more.

Not to mention, Castlelake will match gifts to some religious organizations in certain scenarios. Here’s what the company has stated in its employee matching gift policy:

Castlelake will consider matching gifts to religious organizations when the gift is designated to an ongoing secular community service program sponsored by these organizations and does not propagate a belief in a specific faith. These programs must have a formal mission and a separate program budget. Further, the benefits of the gift must not be limited exclusively to the organization’s members. Some examples of these types of programs are homelessness projects, food banks, shelters, and literacy programs.

Read more about Castlelake’s matching gift program.

Chevron

Chevron matches donations from full-time employees and retirees, and the company offers volunteer grants. When their employees or retirees volunteer 20 hours or more and request a grant, your organization (if eligible) will receive a check!

Here’s what Chevron says about matching to faith-based organizations:

Chevron Humankind will provide matching funds and grants to programs operated by faith-based organizations if those programs: (a) are open to all individuals in the community regardless of religious belief; (b) serve a secular purpose, such as a food pantry or a homeless shelter; and (c) do not require participants to join in religious worship as a condition of receiving the services that the nonprofit offers.

Read more about Chevron’s matching gift program.

Davey Tree Expert Company

The Davey Tree Expert Company matches employee donations of up to $500 per team member per year. Many nonprofits qualify for funding through their corporate giving program, including (but not limited to) higher education institutions, environmental groups, health and human services, civic and community organizations, and more.

Check out this blurb from the Davey Tree Expert Company’s matching gift policy regarding religious nonprofits and matching gifts:

Generally, churches and other religious groups are not eligible for matching gifts. However, religiously motivated organizations that provide services for the disadvantaged are eligible. The organization must be a separate legal entity from a church and have its own 501(c)(3) or Canadian equivalent certification.

Read more about Davey Tree Expert Company’s matching gift program.

DIRECTV

DIRECTV offers a highly-generous employee giving program. The company matches employee donations of up to $20,000 annually and provides a grant of $250 after an employee volunteers for 25 hours with a nonprofit cause. Like most companies, DIRECTV provides a detailed match policy, including information regarding religious organizations and matching gifts.

Here’s what DIRECTV says about matches to religiously affiliated causes:

DIRECTV will match gifts to qualified institutions affiliated with religious organizations but will not match gifts made directly to religious organizations.

DIRECTV will not contribute matching funds to churches and religious organizations which fulfill tithes, pledges, or other church‐related financial commitments.

DIRECTV will not contribute matching funds to institutions that restrict admission or aid due to race or religious beliefs.

Read more about DIRECTV’s matching gift program.

Engineered Profiles LLC

Ohio-based plastic design and technology provider Engineered Profiles offers a matching gift program designed to engage employees and empower them to give back to their communities. But will the company match to religiously affiliated groups?

Here’s what the Engineered Profiles matching gift guidelines indicates:

Engineered Profiles will NOT match…gifts made to religious organizations (e.g., churches, temples, synagogues, mosques). Gifts may be eligible for a match if the programs operated by faith-based social service organizations meet the following criteria:

- The organization has a 501 (c)(3) determination letter from the IRS;

- The gift is designated to a particular program that is available and open to all individuals in the community;

- The program is for non-religious purposes (such as a food pantry or domestic abuse shelter);

- The organization does not use the program to promote any religion.

Read more about Engineered Profiles’ matching gift program.

Fitch Group

The Fitch Group, inclusive of subsidiaries like Fitch Ratings and more, matches donations made by qualifying full-time and part-time employees to a wide range of nonprofit causes. Each team member is eligible to request $1,000 in matches per year at a dollar-for-dollar rate.

Additionally, Fitch Group specifies the following in their documentation regarding religious organizations and matching gifts:

Organizations founded and operated exclusively for charitable purposes (including educational, scientific, or religious) are eligible recipients of donations, provided they are located in the U.S. or one of its possessions; qualify for exemption from federal income tax under Section 501(c)(3) of the U.S. Internal Revenue Code; and are generally eligible to receive tax-deductible contributions.

Read more about Fitch Group’s matching gift program.

The Gates Company

Employees of the Gates Company qualify for a particularly generous matching gift program facilitated through Gates Industrial Corporation Foundation. Donations made between $25 and $50,000 are eligible to be matched, with most nonprofit causes qualifying for funding.

Gates Industrial includes the following guidelines regarding religious groups in their matching gift criteria:

Donations to churches or religious organizations, organizations that discriminate or which promote a political party or candidate, or which advocate particular positions on specific areas of public policy will not be matched.

While direct gifts to churches or religious organizations do not qualify, many activities that are church sponsored in the areas of youth, senior citizen, minority, or disabled may qualify. Such sponsored programs must be conducted by separate organizations which have qualified under Section 501(c)(3) of the Internal Revenue Code.

Read more about Gates Industrial Corporation’s matching gift program.

General Electric

In 1954, GE became the first company to offer an employee matching gift program. At the time, GE only matched to higher education institutions but has since expanded its matching to encompass most schools and nonprofits.

Here’s what GE’s guidelines have to say about whether churches, synagogues, mosques, and other houses of worship are eligible for matching gift funds:

Ineligible recipient organizations include religious organizations (churches, synagogues, mosques, and other houses of worship), or other organizations primarily promoting religious purposes. Other faith-based community service organizations or schools may be considered eligible if their programs:

- Are open to all individuals in the community regardless of religious belief;

- Serve a secular purpose, such as food pantry, homeless shelter, or education;

- Do not require participation in prayer, worship, or other religious activities as a condition of receiving service(s) offered; and

- Do not use the individual donation or resulting match for religious purposes.

Read more about General Electric’s matching gift program.

The Pew Charitable Trusts

The Pew Charitable Trusts program provides a 2:1 match on employee donations up to $10,000 annually (meaning a $20,000 match). In other words, eligible donors can triple their gifts! Plus, they offer one of the most religiously inclusive matching gift programs that we’ve seen.

Here’s what The Pew Charitable Trusts says about matches to religious organizations:

Yes, Pew will match contributions made to religious organizations, such as houses of worship, schools, hospitals, shelters, etc., just as it would to any other qualifying organization.

Read more about The Pew Charitable Trusts’ matching gift program.

Verisk

Verisk Analytics and its numerous subsidiaries offer a flexible matching gift program with which (full- and part-time) employees, directors, retirees, and spouses and domestic partners are encouraged to get involved. Each year, current employees can request up to $5,000 in matches, while retirees are eligible to request up to $2,500 on an annual rolling basis.

Here’s what Verisk has to say about matching gifts for religious organizations:

The following gifts are not eligible for matching under the program:

Gifts for religious organizations, unless the specific program is nondenominational in nature and benefits a broad range of the community (e.g., soup kitchen, homeless shelter).

Read more about Verisk’s matching gift program.

How Double the Donation’s matching gift software can help

When a nonprofit incorporates a tool like our matching gift database and automation platform, they’ll be able to instantly determine matching eligibility and maximize their fundraising revenue. Donors might double (or even triple!) their contributions with the help of their employers. The key is to determine your organization’s eligibility with matching gift companies and to make donors aware of available opportunities.

So how do you know if your organization can benefit from Double the Donation’s service? We love to grow our business, but we only want to accept customers who we believe will benefit from our service.

It’s important to remember that many companies will match to religious organizations that provide services to the broader community (e.g., food banks, homeless shelters, schools, etc.).

The easiest way to determine whether our matching gift service would be beneficial is to look over your donation records. If you’ve received matching gifts from companies in the past, there’s a good chance your organization meets the general eligibility requirements.

How the Matching Gift Database Works

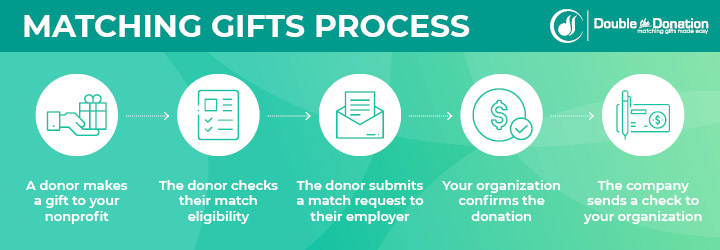

The number one reason why donors don’t submit matches is that they simply don’t know the opportunity exists—let alone how to check their eligibility and submit a request. However, the matching gift submission process is fairly straightforward.

It looks like this:

- A donor makes a gift to your nonprofit.

- The donor checks their match eligibility.

- The donor submits a match request to their employer.

- Your organization confirms the donation.

- The company sends a check to your organization.

Ultimately, donors tend to get stuck on the above steps #2 and #3. Luckily, Double the Donation’s innovative solution continues to simplify the process, making matching gift participation as quick and as easy as possible for your supporters.

When an organization employs Double the Donation’s 360MatchPro, its donors will be able to:

- Search their employers in the comprehensive database;

- View any requirements, restrictions, and deadlines;

- Receive accurate and up-to-date program information;

- Access necessary documents and forms specific to their employers;

- Take specific and actionable next steps from your confirmation screen and/or automated email follow-ups;

- Submit their matching gift requests with ease.

If you determine that your religious organization typically qualifies for matching gifts, Double the Donation may be a useful fundraising tool for you. It’s easy to integrate into your existing fundraising strategy and can help you pinpoint match-eligible donors—instead of waiting for them to come to you. Plus, you’ll save a ton of time that would otherwise be spent chasing down matching gifts by automating the entire process!

Interested? Click here to request a demo of the software to see if it’s right for your team.

Final Thoughts

The bottom line is that religious and faith-based organizations aren’t excluded from matching gift programs as often as you might think. Becoming more aware of which corporations match gifts to religious organizations like yours will help you and your team understand if promoting matching gifts would be beneficial to your bottom line.

Remember, your donors’ employment information is one of your most valuable assets. Collect this data point and compare employers against top matching gift companies to identify available opportunities. Then, check out the companies’ eligibility criteria to see what it says about your religious organization and matching gifts.

Keep up the learning! Discover more matching gift and fundraising advice with our additional resources here:

- Church Fundraising Ideas. Even if your church isn’t eligible for matching gifts, you still have a lot of fundraising potential. In fact, we’ve compiled a list that covers many popular and unique events, activities, and strategies you can use to raise money for your house of worship.

- Corporate Matching Gift Programs. Need a refresher on the basics of matching gifts? Our comprehensive guide will give you the rundown on these charitable giving programs, including top companies and best practices for success.

- Matching Gift Guidelines. Still have questions about your religious organization’s match eligibility? Check out this guide that breaks down common criteria to be familiar with, including minimum and maximums, match ratios, qualifying nonprofits, and more.