Donations of stocks, mutual funds, and other securities are increasing in popularity as a way for individuals to support their favorite causes. After all, these gifts offer exclusive financial benefits both to the donor contributing the gift and the nonprofit receiving it. But what about nonprofit stock donations and matching gifts? Are gifts of securities typically eligible to be matched by donors’ employers?

These are good questions—and they’re cropping up more around nonprofits and donors alike. As a nonprofit fundraising professional, you surely understand the value of corporate matching gifts and are seeking to get as many company matches flowing into your mission as possible.

That’s why we’ve put together this guide that will cover everything your team should know about stock donations and matching gifts by exploring the following topics:

Ready to dive into the world of securities and gift matches? Let’s begin with a brief overview of nonprofit stock donations.

Donating Stock to Nonprofits: FAQ

Just getting started with nonprofit stock donations? These are some frequently asked questions—and answers—on the topic.

What are stock donations?

Stock donations are a unique method of giving in which individual donors can support nonprofit causes by transferring ownership of stock shares from themselves to the organization in question.

Stock donations are a unique method of giving in which individual donors can support nonprofit causes by transferring ownership of stock shares from themselves to the organization in question.

Stock donations are also referred to as gifts of securities, which typically encompasses transfers of stocks, bonds, or mutual funds.

In order to secure the full financial benefits of a stock donation, the donor should have held the stock for at least one year from the time of the gift. The organization then has the option to sell the stock immediately upon receiving the donation or allow its shares to continue to appreciate in value. Nonprofits typically outline their generally accepted types of donations and liquidation procedures in their gift acceptance policies.

Other Key Terms to Know:

Mutual fund donations

While stock donations typically involve the transfer of shares within a single company, mutual funds can include a portfolio of thousands of stocks, bonds, and other securities compiled as a single entity.

But when it comes to donating assets to charity, mutual fund donations function similarly to stock donations—and similar rules apply regarding mutual fund and stock donations and matching gifts. Most companies that match gifts of stock will also match mutual fund donations and vice versa.

One thing to note, however, is that the mutual fund transfer process can be a bit more complicated than that of single stocks and may require a more hands-on process by the organization receiving the securities.

Marketable securities

Another term you might see in the realm of nonprofit stock giving is marketable securities. These are a specific category or type of investment, and most publicly traded stocks, and those most likely to be donated to a nonprofit, will fall under this umbrella.

Also known as marketable equity or marketable investments, these are essentially financial assets that are easily liquidated or readily convertible into cash. These are typically considered short-term investments and can be sold with minimal impact on their market value.

Why do individuals donate stocks to nonprofit causes?

Nonprofit stock donations are becoming a favorite giving method among donors for multiple reasons. For one, gifts of securities such as stocks enable donors to contribute more to an organization and its mission than they might be able to on their own.

If an individual purchases $100 in stock from a company that has since appreciated to double in value, they will be able to funnel $200 toward a cause that they care about—despite having only paid $100 for the initial stock shares! (And if the donor’s employer will match their stock donation, the end value can reach higher than $400—but more on that later.)

Additionally, when donating stocks that have been appreciating for more than a year, donors actually contribute 20% more to the nonprofit than if they had first sold their stocks and made a cash donation with the proceeds. That’s because when an individual sells their stock, they’re subject to pay significant capital gains taxes, which are not applicable should they transfer the stock to the receiving organization.

Are all stocks able to be donated to nonprofit organizations?

Most stocks will be eligible for donation purposes to most nonprofit causes. However, some organizations may place certain stipulations on the types of companies whose stocks they will and will not accept.

For example, the American Heart Association refuses donations of stock or other interests in companies relating to tobacco, nicotine delivery, or cannabis. In the case that an individual attempts a stock donation that is not accepted by the organization to which they gave, the securities will ultimately be returned to the donor.

Nonprofits That Accept Stock Donations

Many nonprofit organizations accept charitable gifts of stocks and mutual funds, and the trend is continuing to grow. In the next few years, we can expect more and more charitable causes to collect and incorporate gifts of securities into their overall fundraising strategies.

Donors interested in contributing stock to a particular cause are encouraged to explore their website, as the information regarding stock donation acceptance is often included within the organization’s “ways to give” page.

As of now, we’ve pulled a list of ten well-known causes and their current guidelines for donating stock.

1. American Heart Association

The American Heart Association (or AHA) gladly accepts gifts of stocks (and mutual funds) from generous donors and provides easily accessible guidelines and instructions for multiple methods of doing so.

Here’s what their website had to say:

“You can use stock to support the organization through:

- Electronic transfer – Your broker can transfer shares using the AHA’s Depository Trust Company (DTC) number and account number to ensure delivery.

- Mail – You can mail paper certificates to the AHA.

Electronic Delivery of mutual fund shares is the most secure and practical delivery process available. If you would like to donate a gift of mutual funds to the American Heart Association, please contact us to confirm AHA’s brokers can accept the funds.”

Read up on the full program guidelines here.

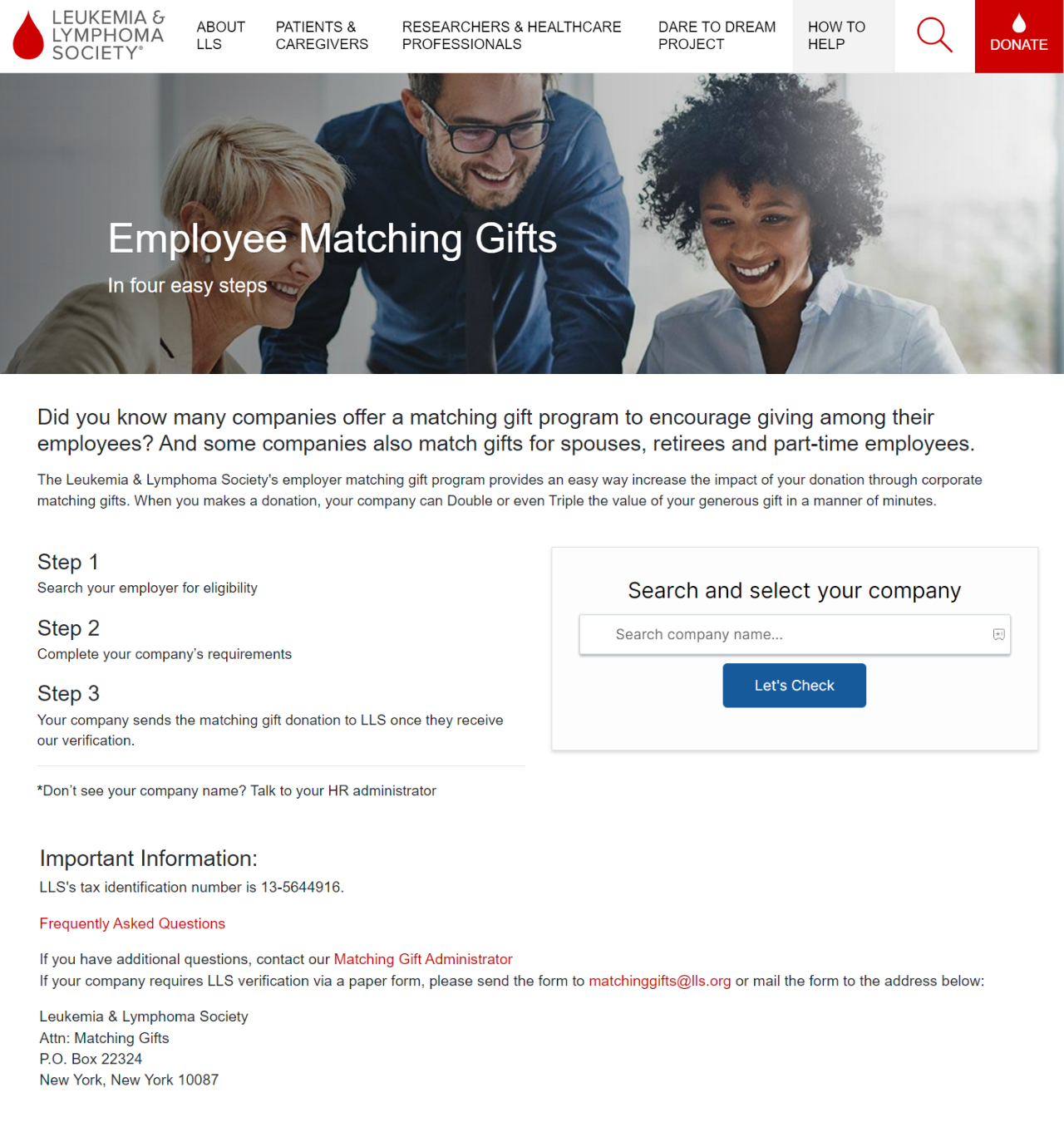

2. Leukemia and Lymphoma Society

The Leukemia and Lymphoma Society, also known as LLS, encourages charitable donations of stock and mutual fund assets as well. They even provide a brief overview of the tax benefits offered to stock donors who are considering the option!

Here’s what their website had to say:

“If you own stock or a mutual fund that has appreciated in price since you purchased it, consider using that asset for your charitable giving. You get an income tax deduction for the full market value of donated securities that you have owned more than one year and you will avoid the capital gains tax on the appreciated value.”

Read up on the full program guidelines here.

3. American Society for the Prevention of Cruelty to Animals

The ASPCA is another organization that accepts stock transfer donations as a way for donors to support their cause. Within their plethora of suggested giving methods, gifts of security are highlighted along with detailed instructions on how to conduct the transfer process.

Here’s what their website had to say:

“For credit to ASPCA – American Society for the Prevention of Cruelty to Animals – Prior to transfer, please call the organization with the name of stock and number of shares to be transferred.”

Read up on the full program guidelines here.

4. Syracuse University

Syracuse University provides donors and prospects with information regarding multiple kinds of stock donations—including marketable securities, closely-held securities, electronic stock transfers via DTC, and mutual fund transfers. Their site also prominently displays contact information for the university’s advancement department which will help facilitate the transfer!

Here’s what their website had to say:

“When planning to make a gift of securities to Syracuse University, please notify Advancement Services. Gifts of publicly traded securities that have appreciated in value allow you to claim a charitable deduction for the full market value of the securities on the date the gift is made. You pay no capital gains tax on the appreciation.

Gifts of stock in closely held corporations may result in substantial tax benefits in the form of charitable deductions and avoidance of capital gains taxes. Closely held securities can be especially attractive in funding charitable remainder trusts or charitable remainder lead trusts. Because special regulations apply to gifts of this kind, we encourage you to consult your tax adviser and the University’s development staff when considering such a gift.”

Read up on the full program guidelines here.

5. Piedmont Healthcare

Piedmont Healthcare utilizes its website to encourage stock donations by interested supporters. One way they do so is by briefly highlighting the benefits to both their institution as well as to the donor contributing the appreciated securities (of both stocks and mutual funds).

Here’s what their website had to say:

“Gifts of appreciated securities, such as stocks or mutual funds, that have been held for over a year are a wonderful way to support Piedmont while potentially realizing important benefits for yourself.

Instruct your broker to transfer shares to Piedmont Healthcare Foundation by contacting Truist Bank via phone or email.

Contact your mutual fund company about the process of transferring mutual fund shares. A special form and signature guarantee will likely be required by them to initiate a charitable transfer.”

Read up on the full program guidelines here.

6. Florida State University

Florida State University provides stock donors (and prospective donors) with detailed instructions that outline the securities transfer process. The FSU Foundation incorporates tips and tricks for donors aiming to contribute stock to the university, whether electronically or with physical certificates.

Here’s what their website had to say:

“When donors’ securities are held in a brokerage account, the donor instructs their broker to transfer the securities to the university’s account.

Donors should also request that their brokers send confirmation of transfer to the FSU Foundation, Inc. The confirmation should indicate the donor’s name, the security being transferred, the Foundation account which should be used, and the date of transfer. Donors should then follow up with a letter to the FSU Foundation with instructions regarding their gift designation so that the gift can be properly credited.”

Read up on the full program guidelines here.

7. National Kidney Foundation

The National Kidney Foundation includes stock donations as one of their suggested ways to support the institution—along with other giving ideas such as cryptocurrency, vehicle donations, fundraising events, and more.

This organization provides interested stock donors with a downloadable PDF made available through their “Get Involved” web page.

Here’s what their website had to say:

“Please complete and email the included form to Cornerstone Advisors Asset Management prior to transfer.”

Read up on the full program guidelines here.

8. Lazarex Cancer Foundation

The Lazarex Cancer Foundation also encourages stock donations within their “How You Can Help” page. This section quickly highlights the significant tax benefits to the organization and the subsequently increased impact a supporter’s gift can make.

Here’s what their website had to say:

“Did you know that your gift could go further by donating stock directly? Direct stock gifts let us use 100% of your donation, rather than losing up to 37% of it to capital gains tax. Thus, you can make a bigger impact at zero additional cost to you. If you would like to make a stock donation, please contact the Lazarex team.”

Read up on the full program guidelines here.

9. St. Jude Children’s Research Hospital

One of the largest youth-focused research hospitals in the nation, St. Jude receives support from a widespread supporter base. Under its “Ways to Give” page, the organization provides a detailed guide on the benefits of stock donations with a step-by-step walkthrough of the process.

Here’s what their website had to say:

“Donating stock directly to a charitable organization, like St. Jude, can increase the amount of money received by the charity while reducing the tax burden for the donor. When you donate appreciated securities (investments that have increased in value from the time they were purchased), some individuals and households may be able to take advantage of IRS tax provisions to claim a charitable tax deduction for the full, fair market value of the securities.

- Step 1: Choose what type of stock and how many shares you want to donate.

- Step 2: Contact your financial institution to request the transfer.

- Step 3: Contact us to inform us of your gift.

- Step 4: Look for a tax receipt and acknowledgment letter for St. Jude.”

Read up on the full program guidelines here.

10. American Cancer Society

For individuals looking to support the American Cancer Society, gifts of security are marketed as a key form of philanthropy under the “Ways to Give” umbrella on the organization’s website. Upon navigating to the “Stock Gifts” page, donors are met with information on various ways to donate stock in support of ACS—including online, physical delivery, and electronic transfer authorization.

Here’s what their website had to say:

“A gift of appreciated securities held for more than one year may provide significant benefits to you as a contributor, such as:

- Entitling you to a charitable income tax deduction for the fair market value of the gifted securities as of the date of the gift.

- Eliminating capital gains tax that would ordinarily become due if you had sold the appreciated securities on the open market and donated the proceeds from the sale to charity

- Claiming your charitable deduction against up to 30% of your adjusted gross income. Any unused deductions can be carried forward over the next five years.

- Providing a way to help you achieve your long-term financial objective of reducing your income and estate taxes.”

Read up on the full program guidelines here.

Matching Stock Donations: The Basics

Clearly, stock donations are a great stream of additional fundraising revenue for nonprofits, and they’re becoming an increasingly sought after resource. At the same time, organizations are looking to get their charitable donations matched by donors’ employing companies.

So, do the two ideas coincide at all? Here’s what your fundraising team needs to know about the relationship between nonprofit stock donations and matching gifts.

Are stock donations typically eligible for corporate matching gift programs?

The #1 factor that determines whether an individual’s stock donation is eligible for a match through their employer is who their employer is and what that company has established in its matching gift program guidelines.

For example, some companies consider gifts of securities a particular form of in-kind donation (which the company chooses whether or not to match based on their program guidelines). In that case, stock donations made by employees of these companies will be eligible as long as that company matches in-kind gifts.

On the other hand, many businesses have classified stock donations as a form of monetary gift (in the likes of cash, debit/credit payments, or bank transfers) or a common exception to the in-kind donation rule. Donors employed by these companies are typically able to secure a gift match on behalf of your organization—so long as the value of the stock falls between the businesses’ predetermined thresholds.

All of that to say, many corporations choose to match the tax-deductible value of a contribution regardless of how it was given to a nonprofit organization – yet, this does vary based on company, so make sure you’re aware of your match-eligible donors’ company parameters.

Additionally, you’ll want to keep in mind that, as gifts of securities continue to grow in popularity among donors, we can expect many companies to begin adopting stock-inclusive matching gift program criteria for employee gifts in the near future.

How can I know if an individual’s stock donation qualifies for a match?

Let’s say your organization has just received a generous stock donation from a supporter of your cause. You may already know that their employer offers a matching gift program, and you’re looking to determine whether the stock gift is eligible for a match as well. Or, perhaps you’re unaware of whether the employing company matches any sort of employee donations to begin with. In either case, the answer should be located within the corporation’s matching gift program guidelines.

Nonprofits looking for this information may decide to conduct an online search for a company’s publicly-facing matching gift program guidelines to determine whether stock donations are mentioned. Donors seeking the information on their employers’ giving program can do a similar search of online resources, or they may look to internal documentation in an office policy handbook, workplace giving portal, etc.

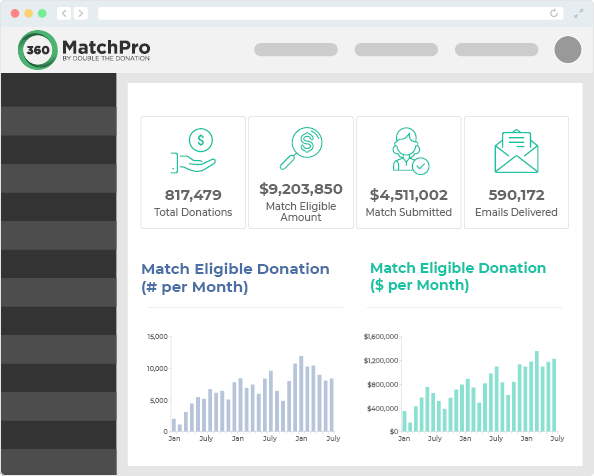

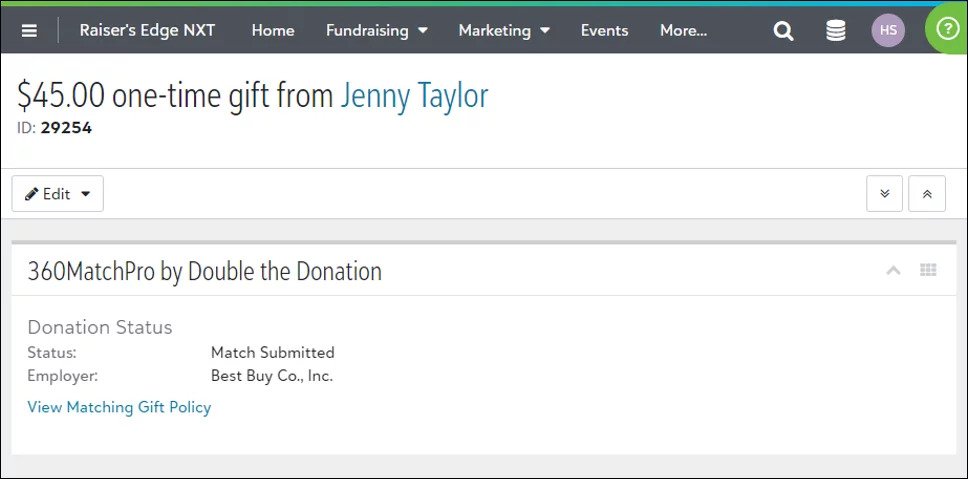

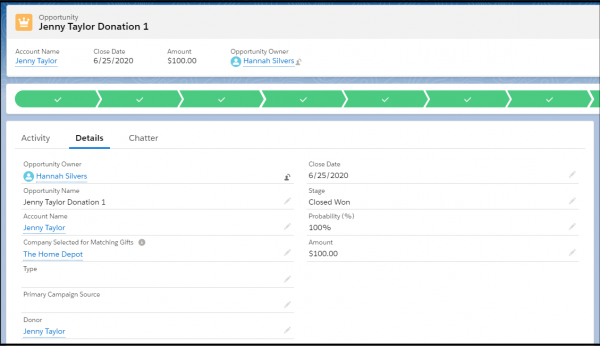

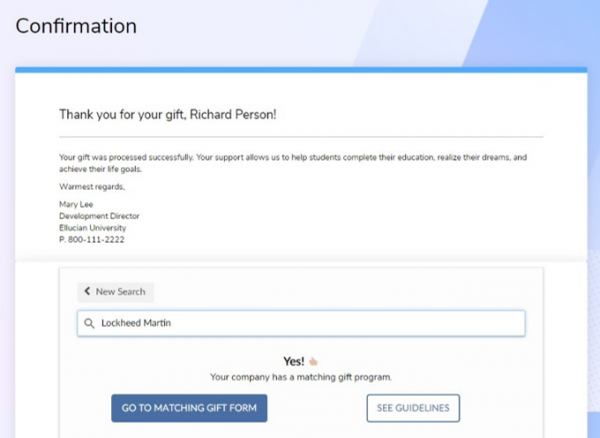

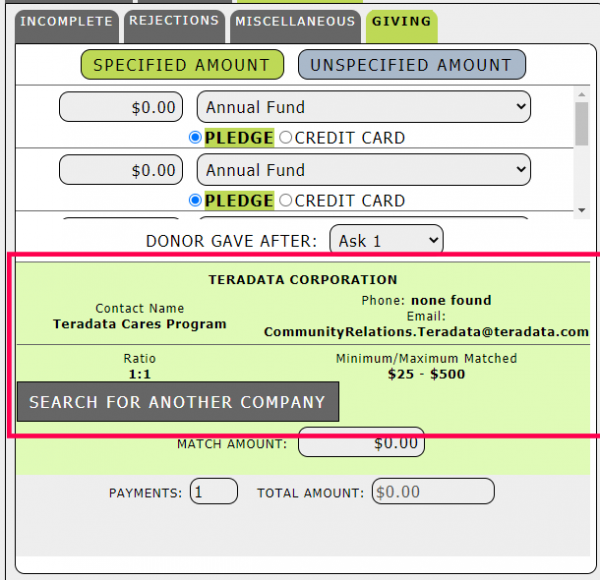

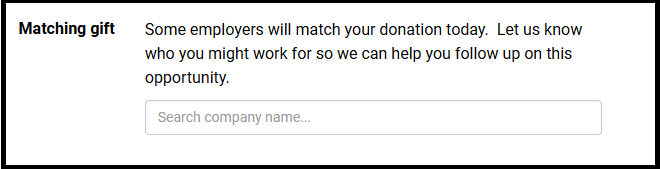

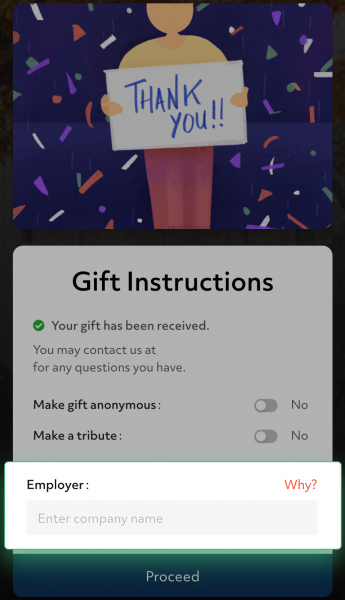

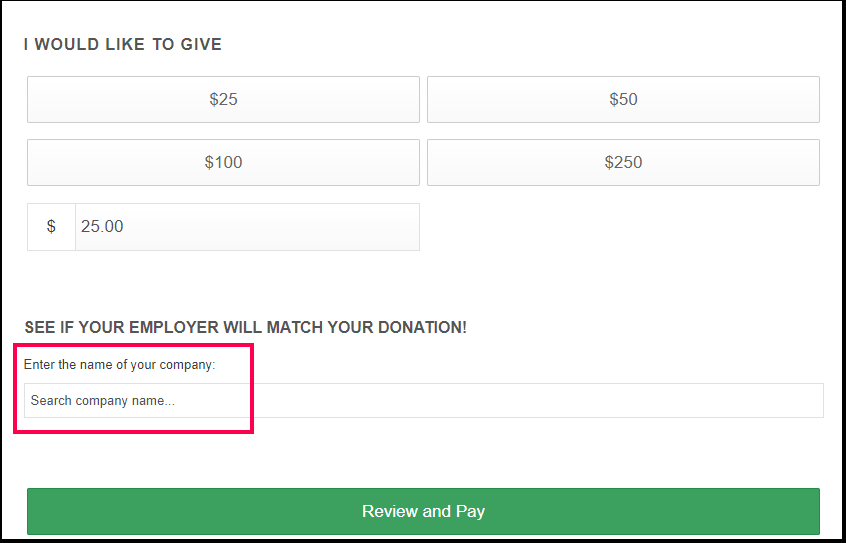

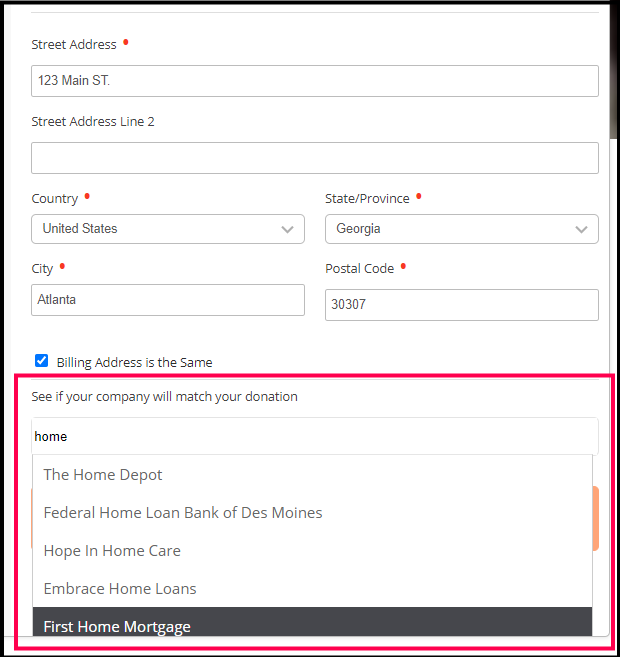

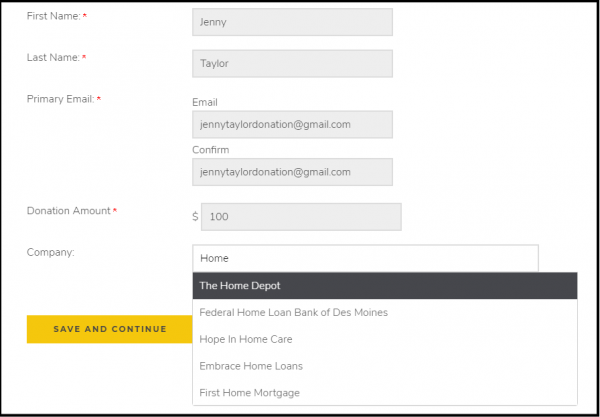

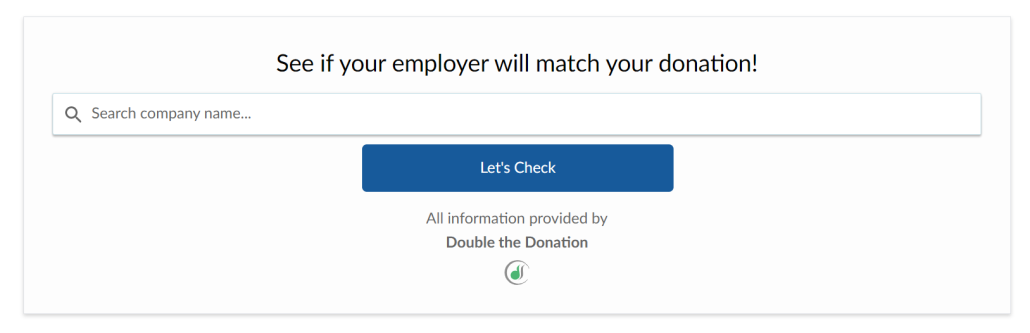

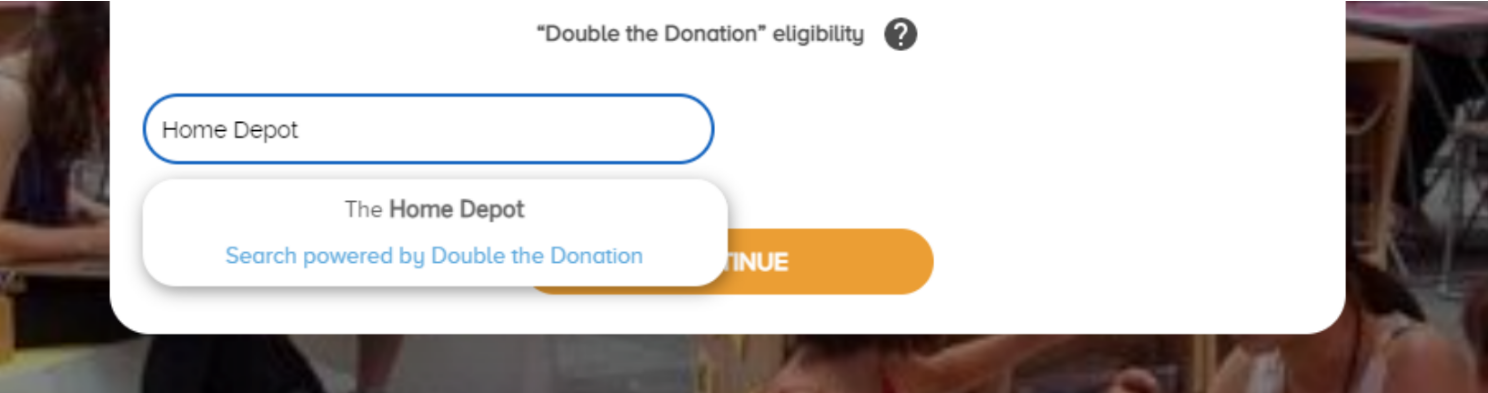

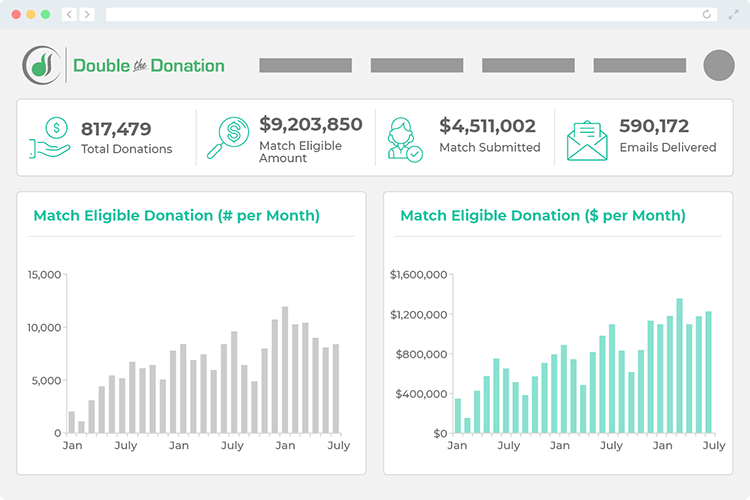

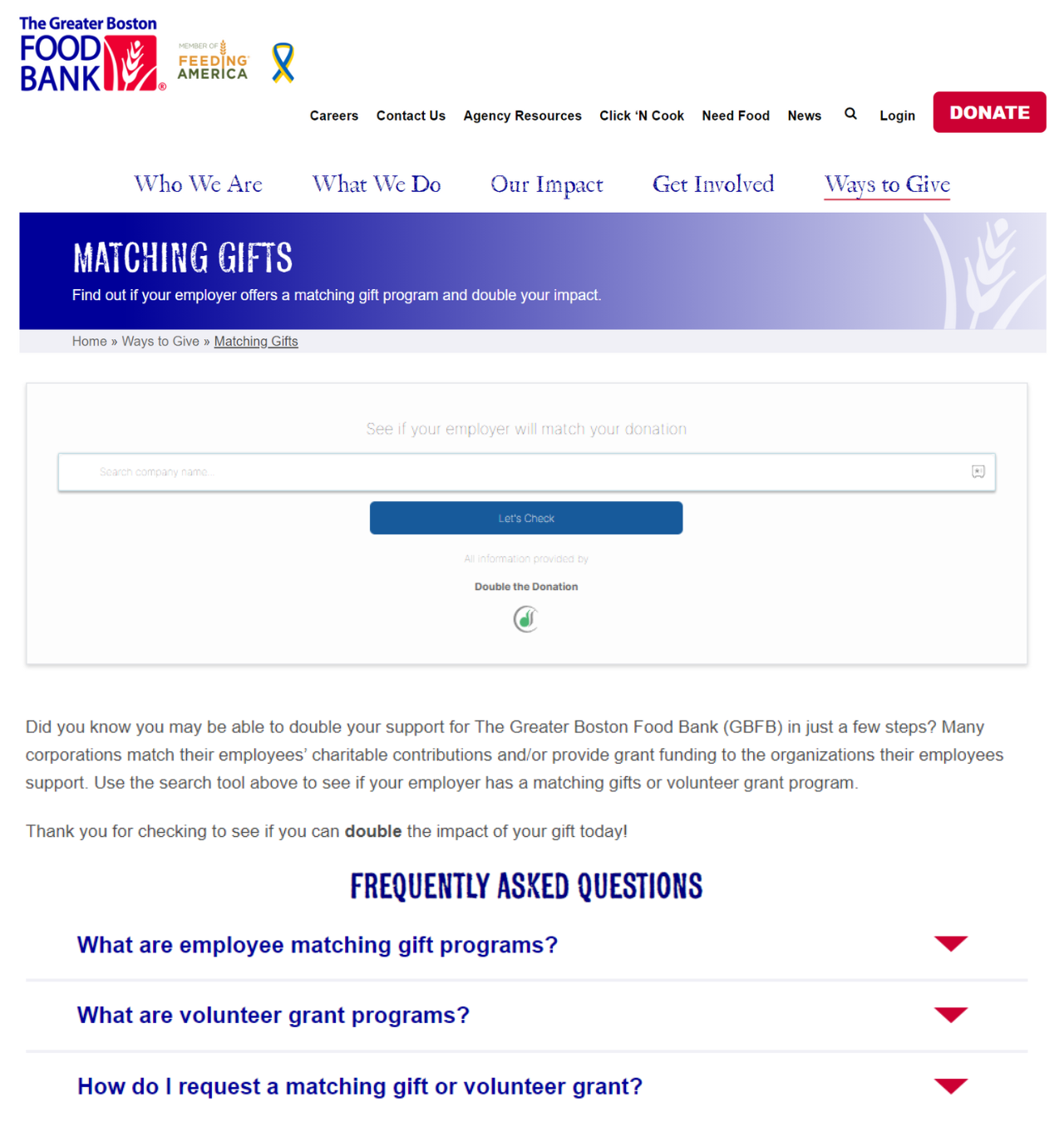

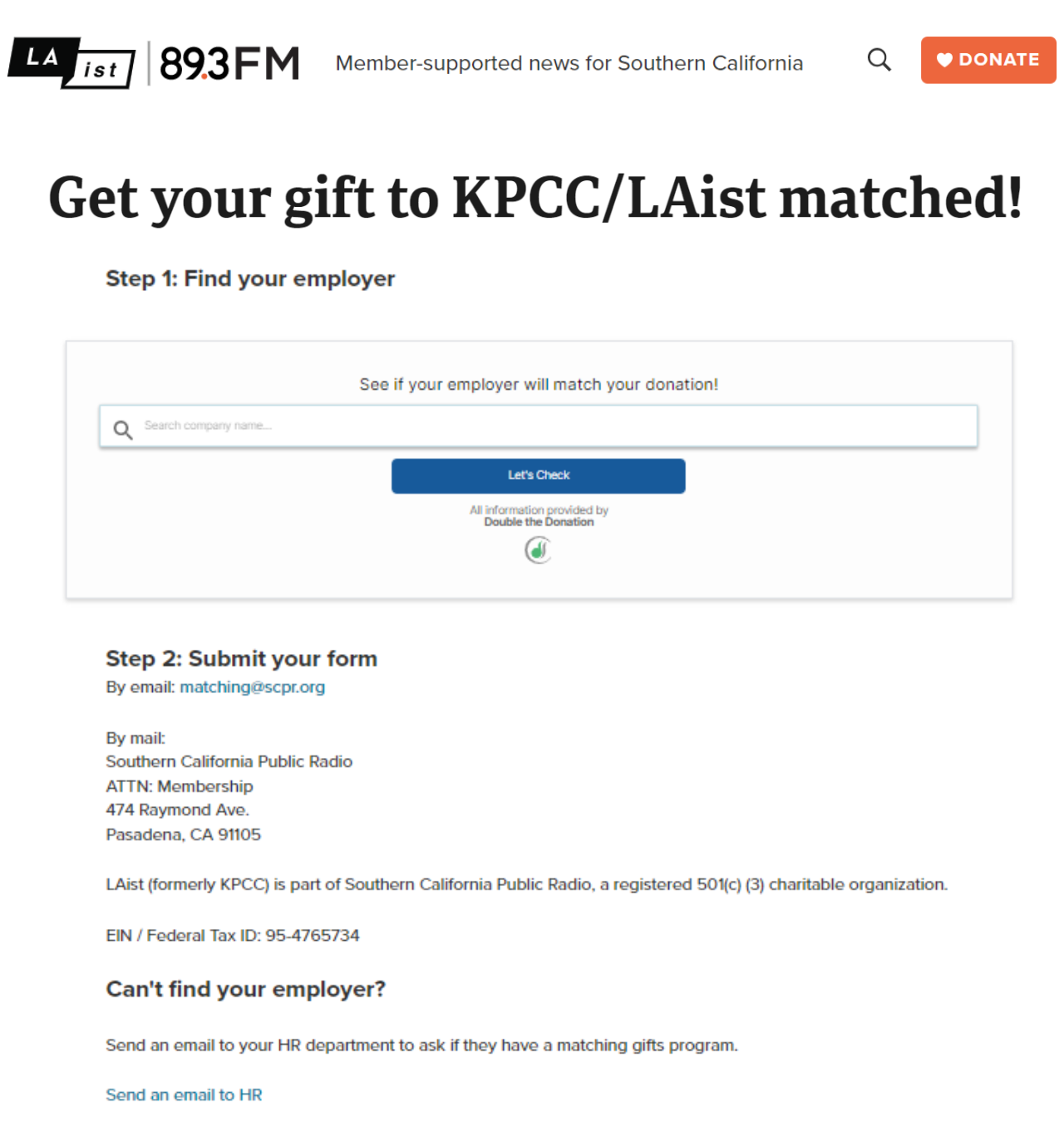

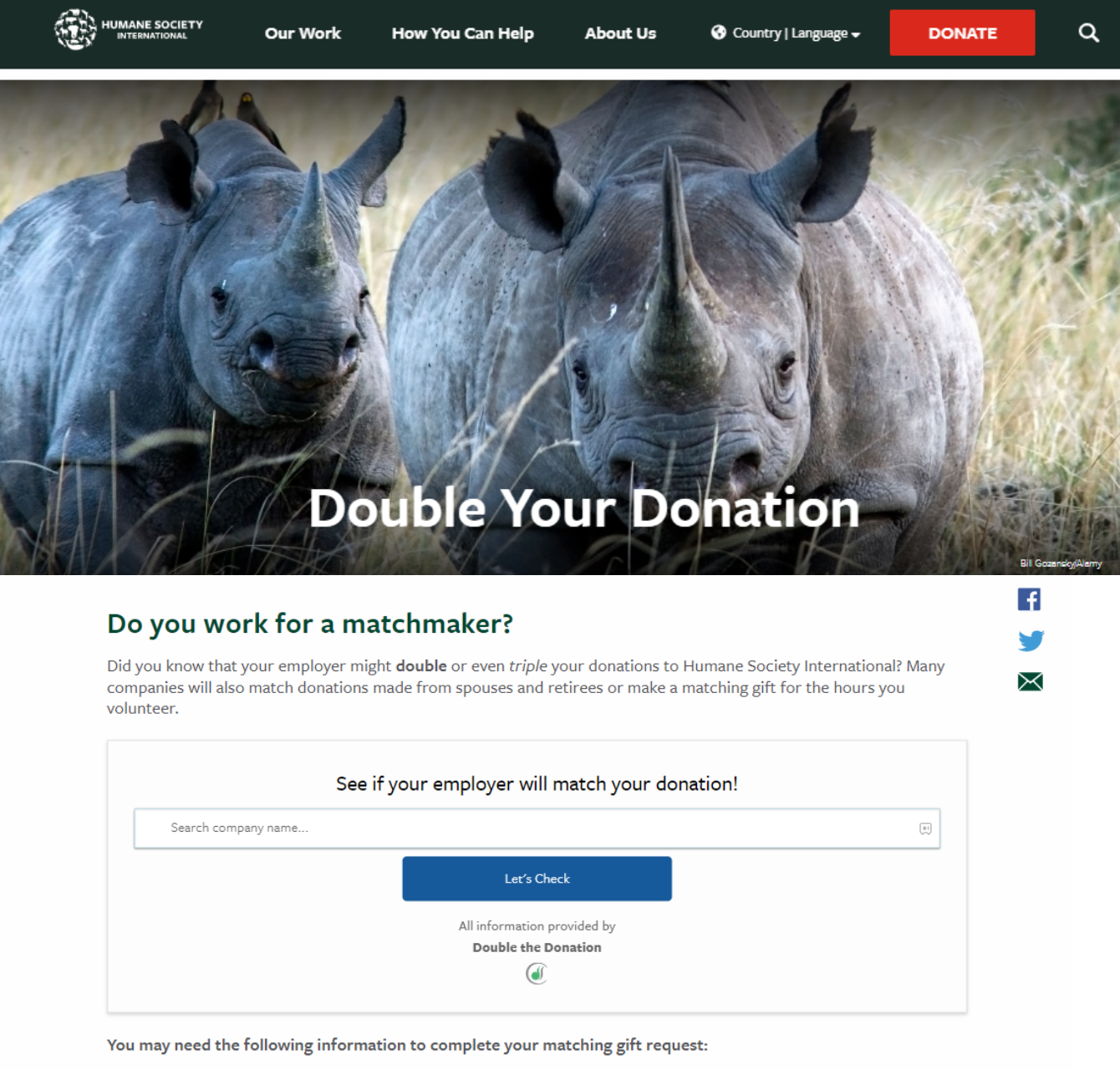

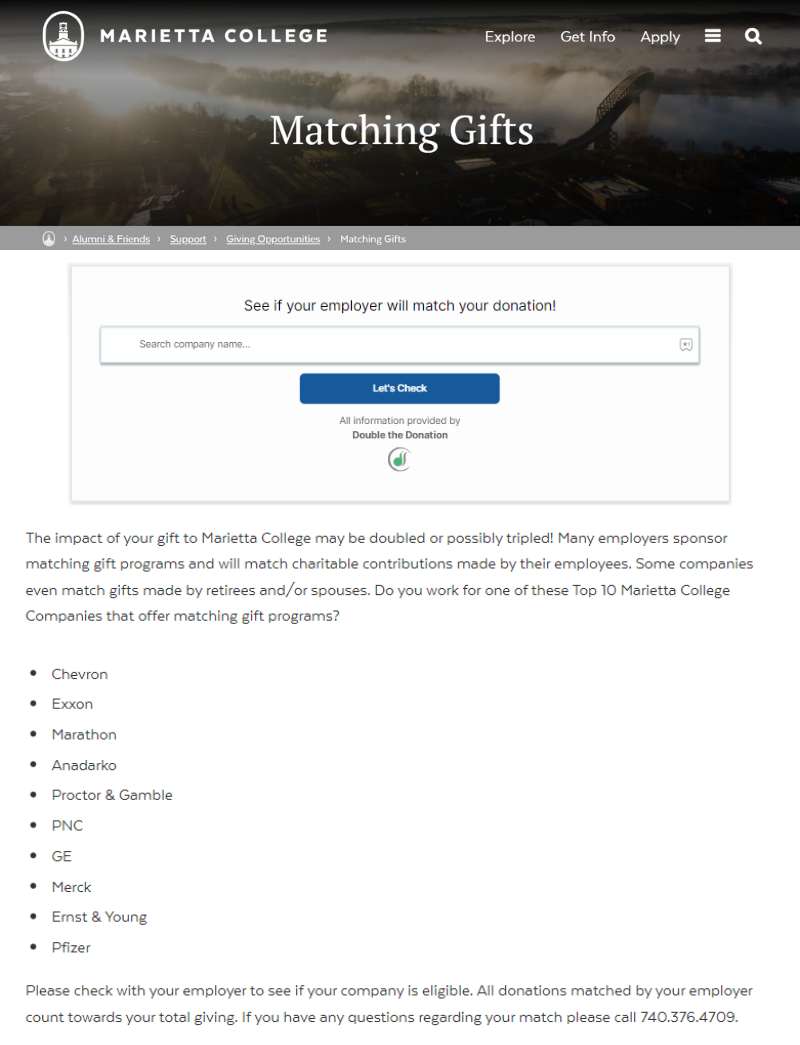

However, the easiest way to uncover match-eligibility status for any donation—stock or otherwise—is by utilizing a matching gift company database.

Luckily, Double the Donation offers the most comprehensive database available, with detailed listings for tens of thousands of companies. Nonprofits and donors alike can begin typing a company’s name within the embedded autocompleting search tool and be instantaneously met with match qualifications, types of eligible donations, and more.

If the provided guidelines mention stock donations as a viable option for matching donations, you have your answer—the gift of stock is likely matchable for your cause!

If available documentation fails to reference gifts of securities at all, we recommend encouraging donors to inquire about the possibility with their companies to find the most definitive answer to the question at hand. Sometimes corporations might not list specific contribution methods, yet those gifts will still qualify for a match!

What are corporate stock donation matches worth?

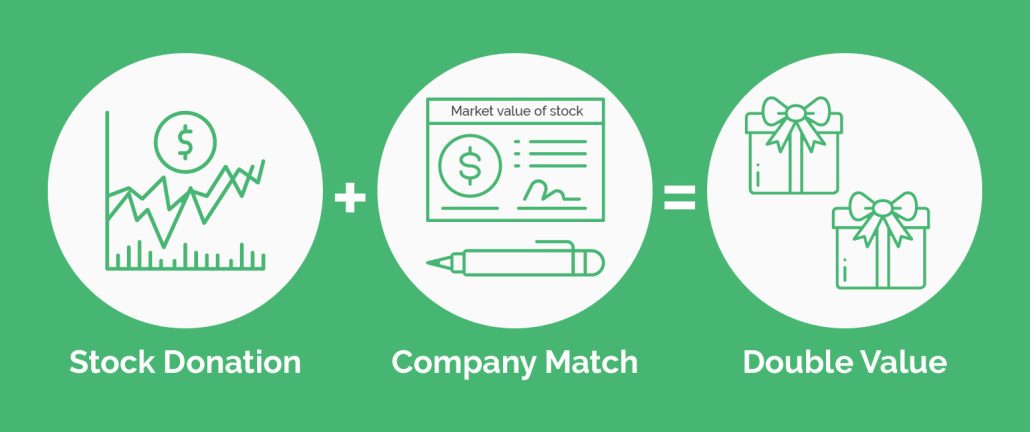

When a stock donation (that has previously been identified as eligible for a corporate matching gift) is requested by a donor, the employer typically agrees to match the value of the stock on the day on which the stock transfer was made.

Thus, nonprofit donors are able to secure a match by their employer equal to the purchase price plus the appreciated value of the stock—which is typically greater than the individual’s initial financial investment!

What trends are expected regarding stock donations and matching gifts?

As of 2024, it’s estimated that many companies are willing to match the tax deductible value of a charitable gift, regardless of how that gift was made – the gift just has to benefit a charity and provide tax deductible value. With that being said, this can vary by company-specific program guidelines. As more and more companies match stocks and mutual fund contributions, it’s important for donors to check with their employer to know which types of gifts might qualify for a match.

The more popular stock grows as a form of nonprofit giving, the more companies will adopt stock-inclusive matching gift program guidelines.

And when you take a look at the financial benefits to parties on both sides of the transaction (one research study reported fundraising growth of up to 55% for organizations that allowed non-cash donations such as stock as viable donation options!), and the ease with which gifts of securities are becoming, this form of gift matching will likely continue to grow.

Examples of Companies That Match Stock Donations

Companies that match employee stock donations do so for the same reason as to why they match cash donations. These typically include corporate tax benefits, increased employee engagement, and positive public relations efforts.

Here are a few examples of companies that match stock donations made by their employees to qualifying charities!

1. Chevron

Chevron is well-regarded as having a generous corporate matching gift program, agreeing to match up to $10,000 in charitable donations per employee on an annual basis. And the best part is that they do match the market value of stock donations that their employees transfer to nearly all nonprofit organizations.

Here’s a glimpse at what Chevron says about stock donations and matching gifts:

“Gifts can be given to nonprofits on the Chevron Humankind site via a payroll deduction or credit card payment, or given directly to the nonprofit offline (e.g. check, cash, stock, etc.).”

Read up on the full program guidelines here.

2. Google

Google offers both full and part-time employees the opportunity to participate in its corporate gift-matching initiative! Gifts worth up to $10,000 (including stock donations) will be matched to many nonprofit causes, including educational institutions, health and human services, cultural and community organizations, environmental nonprofits, and more.

Here’s a glimpse at what Google says about stock donations and matching gifts:

“Your gift must be in the form of check, credit card or marketable securities with a quoted market value. Gifts of securities will be matched with cash. The value of the stock will be calculated using the price at the close of the market on the day of transfer of the security.”

Read up on the full program guidelines here.

3. General Electric

General Electric has matched a wide range of employee donations since 1954. In fact, it was the first corporation to roll out a corporate gift-matching program, though it was a fairly limited offering compared to what we see now!

Since then, GE has expanded its employee giving program to encompass new methods of giving—including contributing securities such as stocks—as well as more nonprofits being eligible to receive funding.

Here’s a glimpse at what General Electric says about stock donations and matching gifts:

“Gifts may be made via cash, check, debit/credit card, or stock. Gifts may also be made by current payment from an entity such as a personal foundation or donor advised fund if that entity has been funded solely by the eligible GE participant.”

Read up on the full program guidelines here.

4. Merck

Merck & Co. matches numerous types of employee donations to charitable organizations. Within the company’s matching program criteria, they include a fairly detailed account of stock donations—including the process for requesting a corporate match and the benefits employees receive from giving this way.

Here’s a glimpse at what Merck says about stock donations and matching gifts:

“Matching funds can be requested for one-time cash, check, credit card, or stock donations, via the Merck Gives Back (MGB) website.

When making a stock donation, enter the market value of the stock on the day you issued the stock to the nonprofit organization. The organization will be asked to confirm the realized value of the stock donation and the Merck Foundation P4G program will match funds equal to the realized value of donated stock.

You can deduct the full current value of the stock (regardless of purchase price) and avoid the capital gains taxes associated with selling the stock for profit; therefore, you pay no taxes on the appreciated value of the stock and take the full deduction for the current value of the stock.

You may not donate Merck stock options; however, you may donate Merck stock after you exercise your options.”

Read up on the full program guidelines here.

5. State Farm

State Farm Insurance matches donations made by current full-time employees, part-time team members, and retired workers alike—in any way they give to nonprofits. This includes gifts of securities and mutual funds, for which they detail a few stipulations of match eligibility.

Here’s a glimpse at what State Farm says about stock donations and matching gifts:

“Donations of Mutual Funds Units and Securities traded on the New York Stock Exchange, American Stock Exchange or NASDAQ National Market meeting the following requirements:

- The eligible donor must be the sole owner or have final authority to transfer ownership of the security or mutual fund unit to the eligible organization.

- Ownership must be signed over to the eligible organization.

Please note: The exact value of the donated securities or mutual fund units will be based on the closing market price the date the transfer is complete.”

Read up on the full program guidelines here.

6. Verizon

Verizon offers its employees multiple matching gift program options, the individual matching grants program being the one in which stock donations are considered match-eligible contributions. The company matches to nearly all 501(c)(3) organizations (or an equivalent internationally), with schools being eligible for a $5,000 donation or stock match and other nonprofits for a $1,000 donation or stock match.

Here’s a glimpse at what Verizon says about stock donations and matching gifts:

“Donations must be in one of the following forms: Personal check, Paypal, money order, payroll deduction, credit/debit card payment, wire/bank transfer, transfer of stock certificate.”

Read up on the full program guidelines here.

7. Apple

Apple offers a slightly different type of corporate stock donation-matching program but will match certain gifts of securities nonetheless. Apple matches any type of stock donations as well as donations of just Apple stock.

Here’s a glimpse at what Apple says about stock donations and matching gifts:

“Visit the Employee Giving portal to request a matching donation for your volunteer time or to make a one-time or repeating monetary donation to the charitable organization (or cause) of your choice using a credit card or PayPal account. You can also request a match for a monetary or stock donation you’ve already made.

To be eligible, your monetary donations must be paid in full — not pledged — via cash, personal check, credit card, PayPal, or Apple stock.”

Read up on the full program guidelines here.

8. Edwards Lifesciences

Edwards Lifesciences, a leading medical technology company based in Irvine, California, matches donations up to $5,000 per full-time employee per year.

Here’s a glimpse at what the company says about stock donations and matching gifts:

“Edwards Foundation will match the tax-deductible portion of employee’s gifts made by cash, check and credit card. The Foundation will also match stock donations, as well as gifts coming out of an employee’s donor-advised fund (DAF).”

Read up on the full program guidelines here.

9. Bank of America

With a matching gift program that doubles team member gifts of between $24 and $5,000 per person per year, Bank of America reports contributing more than $25 million in matching gifts per year!

Here’s a glimpse at what the company says about stock donations and matching gifts:

“Gifts must be personal contributions paid directly to organizations (cash, check, credit card, securities, etc.) or paid through Bank of America’s employee giving platform via payroll deduction or credit card.”

Read up on the full program guidelines here.

10. PNC Financial Services

The PNC Financial Services Group, Inc. incentivizes its employees to give back to the causes they care about. And it does so with a matching gift ratio of up to 4:1—and a program that’s inclusive of gifts of stock.

Here’s a glimpse at what the company says about stock donations and matching gifts:

“Gifts must be in the form of a check, credit card, or marketable securities with a quoted market value. You may be asked to provide proof of your contribution in the form of a canceled check, bank statement, credit card statement, or a transfer of stock certificate. Gifts of securities are valued based on the date of the gift.”

Read up on the full program guidelines here.

11. EOG Resources

EOG Resources encourages giving among its workforce with a particularly generous matching gift program. In fact, its matching gift annual maximum of $75,000 is one of the highest program caps available, inspiring team members to give bountifully as well.

Here’s a glimpse at what the company says about stock donations and matching gifts:

“Employee must attach a copy of the 1) check, 2) debit/credit card receipt, 3) brokerage statement for a stock donation, or 4) check issued by my personal or family foundation or donor-advised fund.”

Read up on the full program guidelines here.

12. Eli Lilly and Company

Indianapolis-based pharmaceutical company Eli Lilly invites its current full-time, part-time, and retired employees to get involved with its philanthropic efforts! Matching up to $30,000 for current team members and $7,500 for retirees on an annual basis, the company demonstrates its commitment to doing good by giving back to the organizations its staff supports.

Here’s a glimpse at what the company says about stock donations and matching gifts:

“A contribution must be in the form of a check, credit card, or marketable securities (with an established market value determined by the average price on the day the contribution is made).”

Read up on the full program guidelines here.

There’s no one-size-fits-all answer when it comes to nonprofit stock donations and matching gifts. Some companies will match employee gifts of securities, while others will not.

But the good news is that more and more corporations are beginning to be inclusive of stock and mutual fund donations within their employee matching programs. That means you’ll want to keep an eye out for new programs being established and existing matching gift companies expanding their eligibility criteria.

Interested in learning more about matching gifts and other nonprofit fundraising opportunities? Check out these other Double the Donation resources:

Stock donations are a unique method of giving in which individual donors can support nonprofit causes by transferring ownership of stock shares from themselves to the organization in question.

Stock donations are a unique method of giving in which individual donors can support nonprofit causes by transferring ownership of stock shares from themselves to the organization in question.