Principal Gift Fundraising: Securing Transformational Gifts

Nonprofits thrive on the support of major donors. The most major of the major gifts a nonprofit might receive are called principal gifts.

Principal gifts bring transformational benefits and drive incredible impact, growing organizations’ capacities to run programs, serve constituents, and make a difference. They’re elusive but achievable when you have an intentional strategy to identify and secure them.

What’s a Principal Gift?

Simply put, a principal gift is a large donation made to a nonprofit by a major donor.

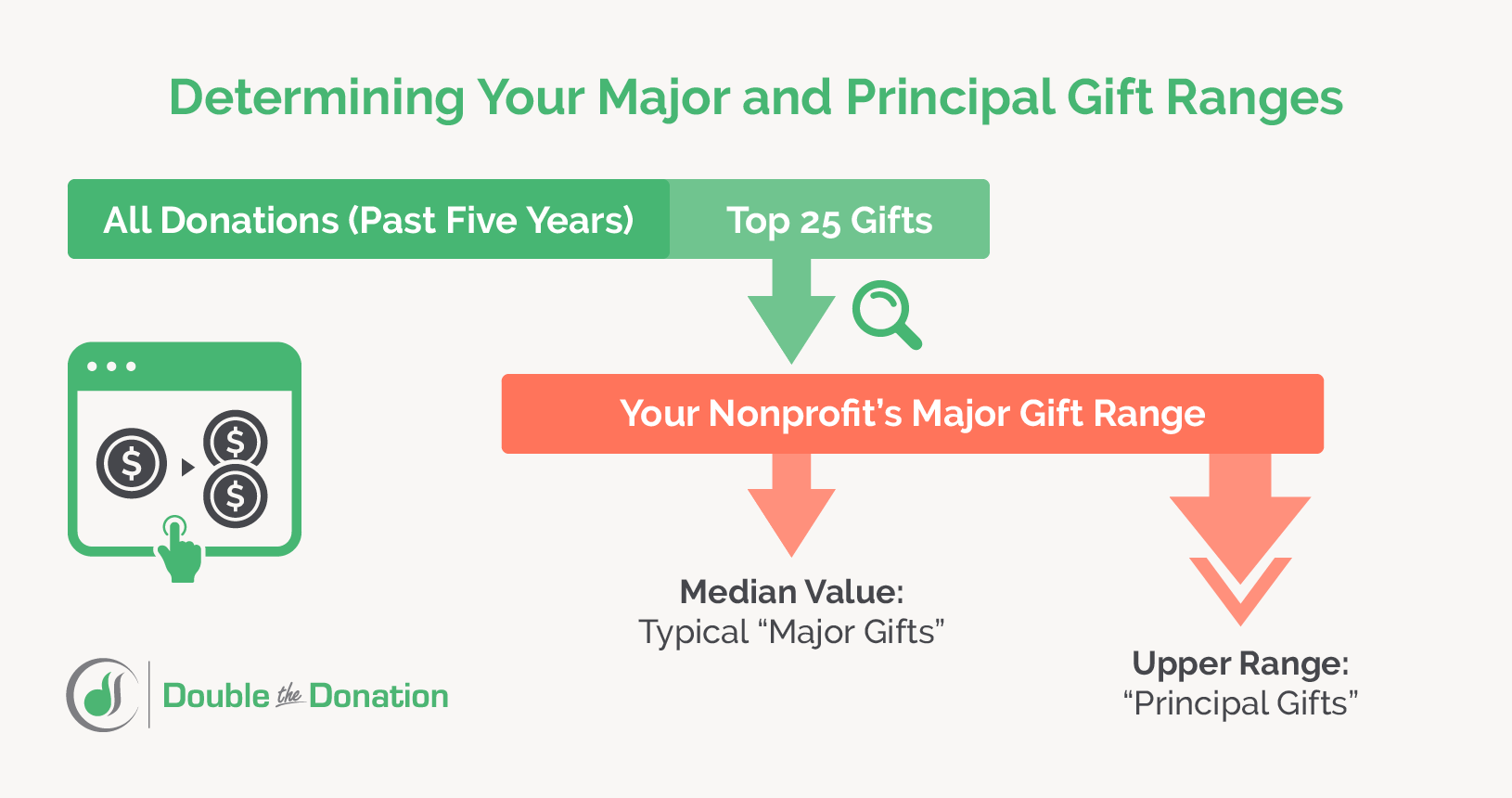

Nonprofits commonly consider principal gifts to be worth $1 million or more, but it’s important to remember that their exact value is relative to the size of an organization’s average gifts. You can define a rough range for major giving for your organization by identifying your top 25 or so gifts received within the past five years and determining the median of this range. This number can serve as a minimum for defining major gifts. Principal gifts would fall at the very top of (or far above) this range.

So how do you snag a principal gift? What background knowledge and strategies do you need to succeed and start transforming your organization?

In this crash course, we’ll take a closer look at principal gifts, how to pursue them, and other ways to maximize the value of your development efforts through tactics like corporate philanthropy.

Understanding Principal Gift Fundraising

Before you can begin laying out a principal gift fundraising strategy, you’ll need to understand some important context.

Principal gifts vs. major gifts: What’s the difference?

A principal gift is a major gift, but a major gift is not necessarily a principal gift.

As explained above, your organization’s definition of a major gift is highly relative to your donor base and average fundraising data. A principal gift is simply a large gift at the top of or above that range of major giving.

Nonprofits pursue major and principal gifts using similar tactics but note that principal gifts have an especially long lifecycle. The larger the gift, the more discussions, care, and due diligence that go into the process. This is also true because principal gifts can generate significant publicity when given by high-profile philanthropists. Options should be weighed carefully before nonprofits and principal donors make public “investments” in one another and link their images.

You may also encounter the term lead gift. These are also large major gifts, but they’re received specifically in the context of major fundraising campaigns. A capital campaign’s fundraising goal, for example, is traditionally topped by a large lead gift, followed by a couple of smaller (but still major) gifts, and then more and smaller gifts down the line in a pyramid structure. This approach is highly efficient, allowing nonprofits to focus first on the handful of highest-impact gifts that will push the campaign the furthest forward.

Who gives principal gifts?

Major donors give principal gifts to nonprofits.

Sometimes, but not always, these donors are high-profile, high-wealth philanthropists—think Mackenzie Scott making waves in the nonprofit world with a new mega-gift. This situation is often what nonprofits imagine when they hear the term “principal gift.”

But again, it’s important to remember that the value of major gifts is relative and that no two donors are alike. What they do have in common is the capacity and inclination to give major gifts, whatever that might mean for your organization.

If you’ve taken concrete steps to invest in prospect research and major gift fundraising, there’s a good chance you’re already in touch with (or in the orbit of) a potential principal gift donor for your organization’s major giving range.

How are principal gifts usually given?

Principal gifts are not usually given out of cash but rather from saved assets (or a mix of cash and assets).

These non-cash assets often include:

- Real estate

- Stocks and other tradable securities

- In-kind gifts of valuables like jewelry or art

- Grants from donor-advised funds (DAFs)

- Planned gifts like trusts and annuities

- Cryptocurrency

When you pursue large donations, it’s important to be flexible in the types of gifts you can accept. Wealthy donors often prefer to give from saved assets rather than from liquid cash, not only because this won’t affect their day-to-day finances but also for the unique tax benefits that different non-cash gifts can bring. We’ll explore this best practice in greater detail below.

How do nonprofits pursue these gifts?

Nonprofits pursue principal gifts as part of their development programs, typically overseen by a dedicated staff member.

Nonprofit development provides the core structure and processes for principal gift fundraising. Having a development approach in place is generally a prerequisite for success. (Keep in mind, though, that even small shops succeed with development with the right tools and prioritization tactics!)

The fundraising strategies used for principal gifts are similar to those for other major gifts but heightened in intensity. One-on-one engagement is even more important for principal gift fundraising, for example. Other best practices take increased emphasis, as well, like the importance of networking in the prospect identification process.

How to Build a Principal Gift Fundraising Program: 10 Key Steps

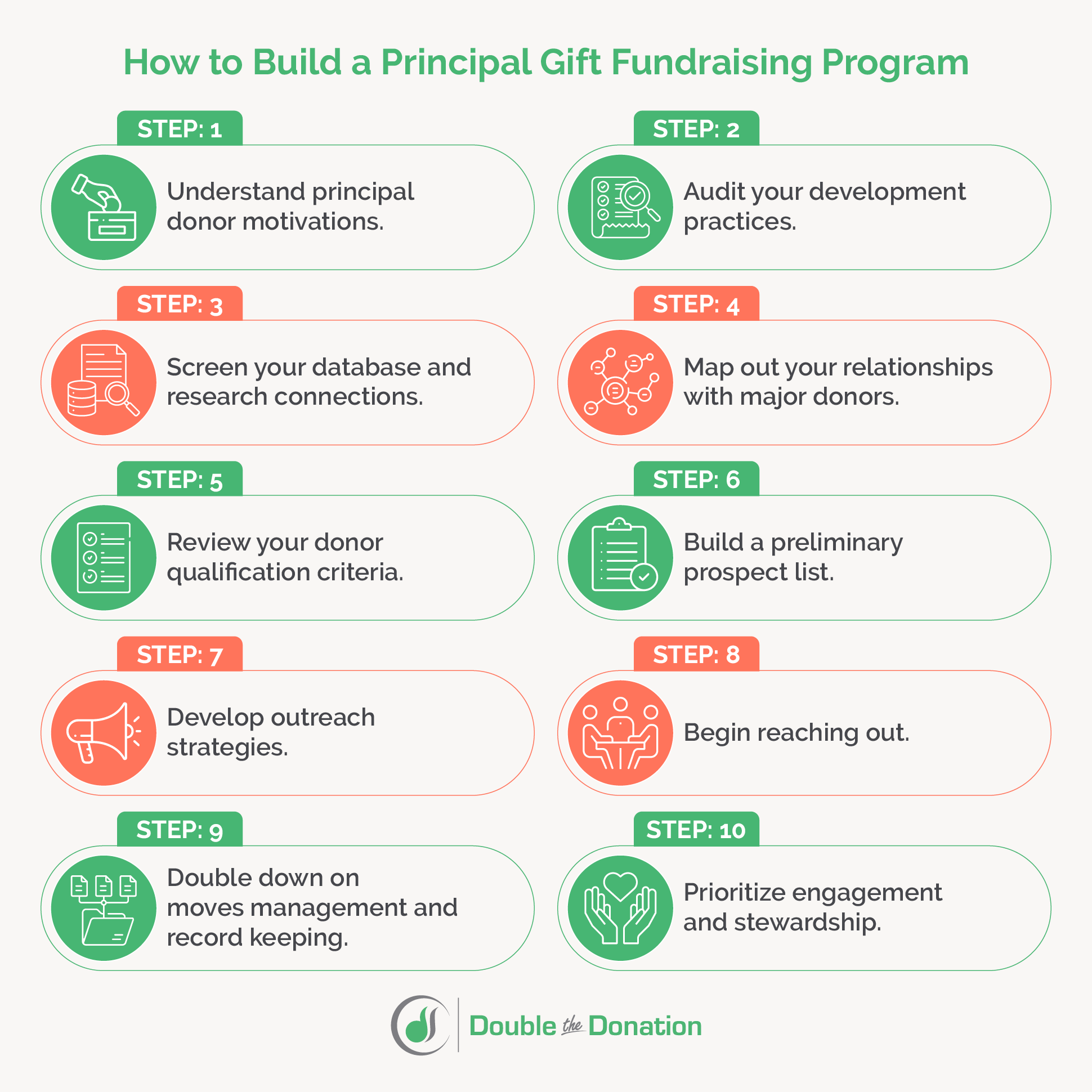

So you’re ready to get serious about pursuing and securing principal gifts for your nonprofit. How do you build a program to support that goal? We break it down into the following key steps:

1. Understand principal donor motivations.

First, take the time to understand why principal donors give such large gifts. As with other major donations, these gifts are motivated by a range of different personal reasons. These might include:

- The simple desire to give back

- Giving back to a personally meaningful cause or institution

- Tapping into significant tax benefits

- Simplifying estate and financial plans with bequests and in-kind donations of property

- Public recognition for personal brand-building

Always keep in mind that philanthropists give strategically—of course, they choose to give to the specific causes and organizations that matter to them, but additional motivations usually come into play. Understand these and you can better align your own goals with those of your prospects.

2. Audit your existing development practices.

Principal gift fundraising occurs as part of your other development practices. Review your current processes for major gift fundraising, planned giving, and other high-impact or nontraditional forms of one-on-one fundraising. Consider the entire major donor lifecycle and the steps, tools, and best practices you use at each stage. These include:

- Prospect research and wealth screening

- Prospect qualification

- Gift cultivation and your messaging during this process

- Your solicitation strategies

- Your stewardship strategies and cadences

- Your nonprofit’s gift acceptance policy (create one if needed!)

Pay extra attention to the logistical processes that drive this lifecycle, especially moves management and your CRM practices. You’ll rely on these for principal gift fundraising just as you do for other giving programs.

Ideally, you’ll have data to refer to. Check out your historical performance with major gifts. Is your prospect pipeline consistently full or running low? Are there stages in the lifecycle where many prospects seem to drop off? Are your qualification criteria appropriate and up-to-date?

Identify potential improvements and make them (and/or consider how you’ll adjust them for principal gifts).

3. Screen your database and research connections.

Next, you’ll begin identifying your first principal gift prospects.

Look to your existing base of support. A pre-existing relationship with your nonprofit is one of the most reliable indicators of giving likelihood. Run a wealth screening to find those donors and contacts with the means to give a gift in the upper half or so of your nonprofit’s defined range for major gifts.

It’s normal in major and principal gift fundraising to branch outside of your direct contacts to find prospects, as well. However, this doesn’t mean cold-calling individuals in your community who you know to be wealthy. Existing, organic connections will yield the best results. Look to your current major donors and consider what you know or could find out about:

- Their families, friends, and community ties

- Their careers, colleagues, and employers

- Past nonprofits they’ve given to or volunteered for

Local histories, publications, social media (especially LinkedIn), the annual reports of other nonprofits, and more are all viable research routes. And remember, if you have strong working relationships with any major donors, don’t be afraid to just ask. Set up a call or lunch to let them know your organization is seeking more high-impact support. Do they have any friends, family, or colleagues who’d also be interested in your mission?

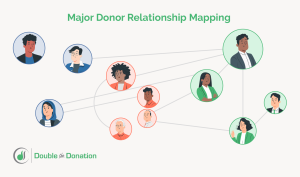

4. Map out your relationships with major donors.

Review everything you’ve learned from researching top prospects and their connections. Then, map it out.

This might mean using a notebook or simple design tool to literally draw connections between your contacts and individuals you’d like to meet—whatever works! You’ll likely be surprised to find that many high-impact donors move in similar social circles, especially in smaller communities.

Visually look for connections and correlate them to your research insights. This process can yield some valuable results. For example, you might find several connections from existing donors pointing to one individual in the community. This person might be a prime candidate for outreach because of the organic personal or professional connections that you already have with them.

5. Review your donor qualification criteria.

Before finalizing a list of prospects, you need to qualify and prioritize them. Principal gift fundraising is highly time-intensive and requires one-on-one communication over extended periods. You’ll need to have a plan to spend your time wisely, that is, by focusing first on those most likely to give.

Qualification is the process of defining the characteristics of a strong giving prospect and using them to update your prospect lists for more efficient and targeted outreach. Qualification criteria can include:

- Certain giving capacities (shaped by your organization’s definition of major gifts)

- Stock ownership

- Property ownership

- Active engagement with your nonprofit

- Active engagement with other nonprofits

- Demonstrated interest in or personal connection to your cause

- Direct, second-degree, third-degree, etc. connection to your nonprofit

- Personal vs. professional indirect connections

Note that some criteria can (and often should) be weighted more heavily than others. Existing direct connections with your nonprofit should be prioritized over indirect connections, or you may learn over time that personal indirect connections are better indicators than professional ones.

Not every prospect will check every box, but this approach does allow you to tackle the prioritization process in a standardized, easily repeatable way. Many fundraising experts recommend making qualification a recurring activity for your development team to ensure continued effectiveness—Graham-Pelton’s donor qualification guide lays out why and how to do this.

You should also keep your qualification criteria up-to-date over time, and create different variations of them for different giving programs. For example, while principal gift donors, major donors, and planned gift donors might share some common characteristics, these are not perfectly overlapping groups. Qualification makes it easy to build in a more targeted approach from the very start.

6. Build a preliminary list of principal giving prospects.

Next, use your qualification criteria to screen the list of donors and prospects you identified in Steps 3 and 4.

Rank them according to your criteria, and you’ll have a handy, easy-to-use shortlist of your very top prospects.

7. Develop outreach strategies.

Now you can begin thinking about how you’ll get in touch with your prospects. Consider these tips:

- Review known communication preferences of existing contacts.

- Look back at previous conversations with existing contacts to refresh yourself on their personal life developments, career changes, etc., and use these to begin new conversations.

- Ask your existing contacts for introductions to new prospects based on the mapping exercise in Step 4.

- Create or update your nonprofit’s general case for support.

- Create more context-specific cases for support if needed. For example, if you’re seeking a lead or principal gift as part of a major fundraising campaign, you’ll need talking points tailored to the campaign’s objectives.

- Prepare some preliminary shareable resources like your annual report, one-pagers, and brochures about your nonprofit and its impact. You likely won’t need these until you’re closer to actually soliciting a gift, but it doesn’t hurt to be prepared.

With these tips in mind, take a closer look at everything you’ve learned about each prospect and conduct more research if needed. Use this information to lay out personalized outreach strategies for each individual.

8. Start reaching out to build relationships.

Begin reaching out! Work your way down your shortlist of prospects, starting conversations, having calls and meetings, and introducing them to your organization, its work, and its needs.

During this stage, take your time and follow standard gift cultivation best practices that you follow for other major gifts.

Take an interest in your prospects’ personal and professional lives, and work to show them how a partnership would drive impact in the community. Remember that gifts of any size can be restricted or unrestricted—if a prospect shows interest in one particular program or service that your nonprofit runs, lean into it.

You should also seek to learn more about your prospects’ giving motivations so that you can best tailor your eventual solicitations. For example, a wealthy middle-aged prospect might be nearing retirement age and interested in financial planning. You could explain to him or her that various types of planned gifts can actually provide donors with regular income payments while reducing their tax bills, making these arrangements ideal vehicles for principal donations.

9. Double down on moves management and record-keeping.

Throughout the cultivation and solicitation processes, keep close track of your touchpoints with prospects. Organized moves management is essential.

Use your CRM to record each touchpoint, add notes, and tag it with the appropriate prospect. This will take all the guesswork out of preparing for your next conversation and determining the right time to make the ask.

Check out our introduction to moves management for a quick overview of this process.

And aside from tracking your interactions with prospects, be prepared to handle other logistics once you make a successful solicitation. Finalizing a principal gift will involve working closely with the donor and perhaps their (and your) lawyer to hash out the details, especially for non-cash gifts that require legal transfers of ownership or other arrangements. Keeping tidy records of your organization’s finances is always important, and you’ll need to have crystal-clear records of your principal gifts.

10. Prioritize engagement and stewardship.

As you build relationships with principal gift prospects, introduce your giving programs, and lay out compelling cases for support, you’ll hopefully soon successfully solicit your biggest donation yet. Thank your donor, work out the fine print, thank them again, and begin facilitating the donation.

What next?

Ongoing engagement and stewardship are already important for your major donors—doubly so for principal gift donors. They are extremely valuable partners for your mission. You should have a plan to:

- Stay in touch and aware of developments in their lives

- Keep them up-to-date on the progress of your work and any specific campaigns or programs they funded

- Offer ongoing opportunities to get involved with event invites, personal meetings, tours, and more

- Offer new giving options over time that you think they may be interested in

By maintaining and growing your relationships with key supporters over time, you’ll retain their support, secure additional gifts in the future, and build a stellar reputation for your nonprofit. Who wouldn’t want to be known as an organization that inspires transformational gifts and fosters a thriving community?

How to Make the Most of Your Development Strategies

You’ve built effective development strategies and are well on your way to securing a principal gift that will take your work to the next level. Your prospect pipeline is humming along, and everyone’s excited to drive your nonprofit’s goals forward. What next?

Stay on the lookout for ways to maximize the impact of your development work. There are all kinds of ways you can generate more value through your giving programs. For example:

1. Promote matching gifts and volunteer grants. These employer-offered CSR perks are effortless ways to boost the value of your donations. Ask your donors (at all giving levels) to check their eligibility, or research it for them. Nonprofits’ board members are also often significant donors—don’t forget that their board service might qualify for volunteer grants through their employers, as well!

360MatchPro by Double the Donation streamlines the entire process for you and creates easy value-adds up and down your donor pyramid. Learn more or request a demo to see our platform in action. For more information on how the platform works, check out this video:

2. Provide flexible giving options. As mentioned above, major and principal donors often like to give from assets rather than cash for numerous reasons. Be prepared to offer and discuss these giving options. Making it easy to give in a preferred way almost guarantees that you’ll raise more in the long run. Look for tools that simplify the process of accepting stock donations, gifts crypto, donor-advised fund grants, and more as needed.

3. Monitor federal and state tax changes. Tax incentives are powerful motivators for donors when large gifts are involved. Stay aware of developments at the federal and state levels so that you can have productive conversations with prospects. Help them understand the potential benefits of donating (but don’t give explicit financial advice—leave that to the financial and legal professionals).

4. Suggest gift-matching challenges to your top donors. Planning a new major fundraising campaign or giving day? Try asking a longtime major donor to offer a unique gift-matching challenge! This involves your major donor matching all gifts made to your organization within a specific timeframe, and it can be an easy way to supercharge your fundraising results in a short time. Plus, it’s an easy way to engage your major donor with a serious opportunity to drive impact.

5. Research further funding connections and opportunities. Keep researching your donors’ and prospects’ connections over time. Major supporters who are philanthropically active might have connections with foundations that you can tap into to get your foot in the door for new grant funding. Wealthy individuals might even eventually form their own private or family foundations—make sure your nonprofit is a preferred partner right from the start.

Additional Considerations of Principal Gift Fundraising

Principal gift fundraising can completely transform your nonprofit’s ability to pursue its mission. But it also comes with unique challenges and considerations to keep in mind:

- By forging such a big partnership with an individual, you link your organization’s image with theirs. Consider their reputation, the publicity that an announced gift will generate, and whether you can (or want to) honor any restrictions that a donor places on their gift. You can turn down a gift in the best long-term interest of your mission. Think carefully about these factors long before soliciting a gift. Reference your gift acceptance policies, and create them now if you haven’t yet.

- Prepare for the logistics of accepting non-cash gifts. You may need to liquidate stock, work with attorneys and accountants to make arrangements for complex planned gifts, or even handle accepting gifts of real estate. Consider these processes in advance and be prepared to invest in new tools, hire external professionals, and expand your bookkeeping practices as needed.

It’s also recommended to look for ways over time to build more business connections as your organization grows. By integrating corporate philanthropy into your development strategies, you can build extremely fruitful and resilient revenue sources for your nonprofit. Ask your major and principal donors about their careers. Learn more about their employers. Use your existing relationships to springboard new corporate partnerships or sponsorships—the sky’s the limit!

New to corporate philanthropy? Here’s the complete playbook.

Despite its nuances and unique considerations, principal gift fundraising is easily the highest-impact form of fundraising that a nonprofit can conduct.

Understand its distinctions and why major donors choose to give. Build and improve upon your existing development strategies, and focus heavily on research and preparation. With the right plan in place and plenty of time to build relationships, you’ll be on your way to securing a transformational gift.

Want to learn more? Take a deeper dive with these related resources: