Nonprofit Basics: Matching Gifts & How They Double Funds

Corporate giving is a big deal for nonprofits. Giving USA’s latest report estimates that companies gave an incredible $29.48 billion to charities in the U.S. in just one year, showing how generous businesses can be. Matching gifts are a special part of this, and these programs provide the easiest way to tap into that funding.

You can multiply your donors’ contributions just by having them fill out a simple form for their employers. However, a jaw-dropping $4-$7 billion in matching gift funds goes unclaimed every year. Charities have a huge chance to get more support, and we’re excited to shed some light on the basics of matching gifts.

What Are Matching Gifts?

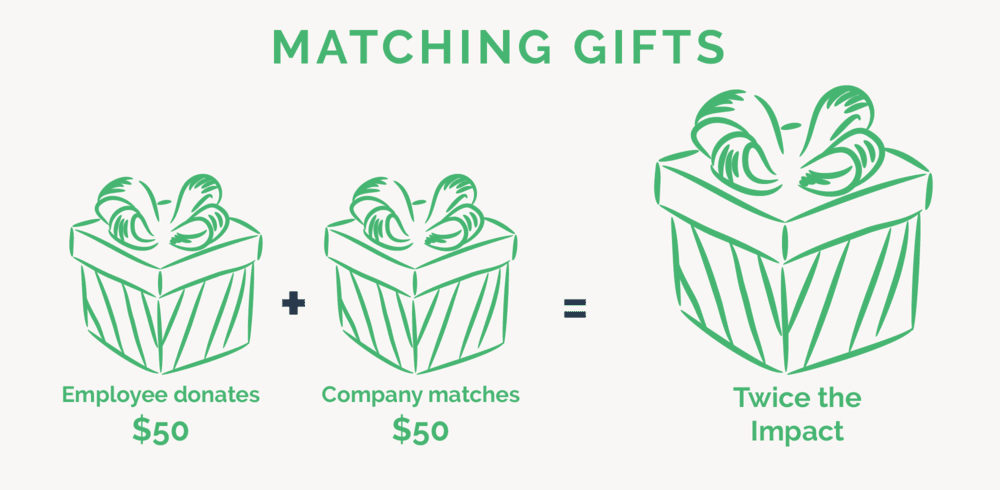

Matching gifts are a type of philanthropy program where companies match donations their employees make to eligible nonprofits, effectively doubling the contribution to the charity. For example, if a Home Depot employee donates $50 to an eligible charity, the company will also donate $50, doubling the total contribution.

This workplace giving program not only amplifies the impact of the original donation but also encourages a culture of giving within the company, aligning corporate resources with employees’ charitable interests. It’s a win-win-win for companies, their employees, and nonprofits!

How Do Matching Donations Work?

When an employee donates to a nonprofit, they can submit a request with details about their gift to their employer, typically through an online portal. Then, the company reviews the donation against their program criteria. If the donation qualifies, the company makes an equivalent donation to the same organization. After receiving the matching donation, the nonprofit should acknowledge the individual donor and their employer.

Note that donation and eligibility requirements will vary depending on the company. When launching a matching gift program, a company will define specifics such as:

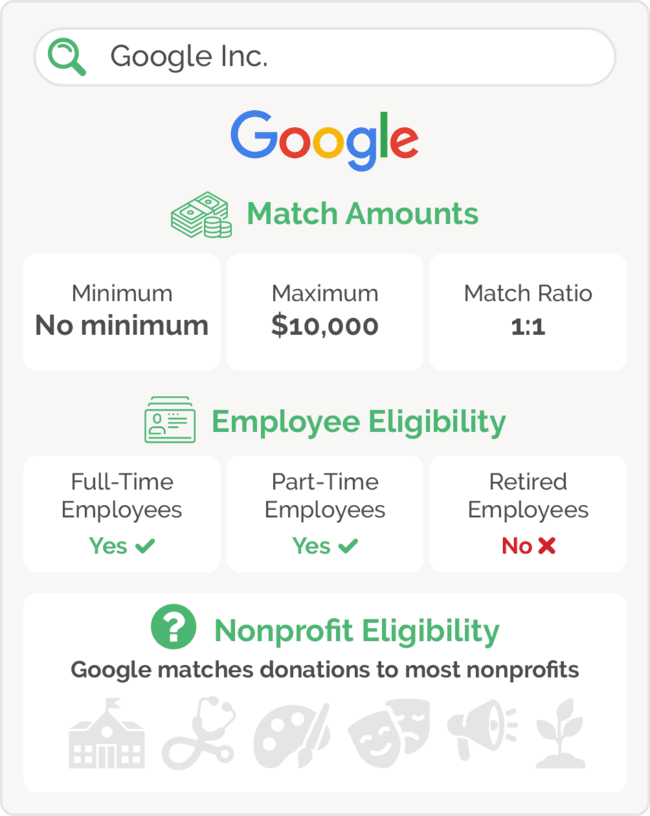

- Maximum Donation Amount: There’s usually an upper limit on the amount a company will match per employee annually. The average maximum match amount is currently $3,728.

- Minimum Donation Amount: This is the lowest donation amount a company will match. Some companies lower barriers to participation by setting very low donation amounts, such as $1 or $5. According to that same resource we just referenced, the average minimum match amount is $34.

- Match Ratio: The match ratio defines how much the company will contribute in relation to the employee’s donation. It’s commonly 1:1. Although it can vary, with some being as generous as 3:1 (AKA a $3 company match for every dollar) or more conservative like .5:1.

- Employee Eligibility: Companies often restrict employee eligibility to full-time employees, with some programs also extending to part-time staff, retirees, spouses, and board members.

- Nonprofit Eligibility: Companies specify which types of nonprofits qualify for matching gifts. Often, they state that 501(c)(3) charities are eligible, but they sometimes exclude certain categories, such as political or religious groups.

A matching gift database can help you quickly find these guidelines. You can easily search for specific companies where your donors work and pull up these criteria.

Benefits of Corporate Matching Gifts For Nonprofits

At its core, matching gifts amplify nonprofits’ fundraising revenue without requiring additional donations from supporters. Here are just some of the ways pursuing matching gifts can impact your nonprofit:

- Broadened Donor Base: Participation in matching gift programs can increase your nonprofit’s visibility among corporate employees, leading to more awareness and support. In fact, 84% of surveyed donors will donate if they’re match-eligible, making matching gifts a great donor acquisition strategy.

- Higher Donations: Knowing their gift will be matched, donors will feel encouraged to make larger donations than they might otherwise. 1 in 3 donors will give a larger donation than originally planned if a matching gift is offered.

- Stronger Corporate Ties: By engaging in matching gift programs, nonprofits can build and strengthen partnerships with companies, leading to further support and collaboration. Even if a company can’t offer a built-out program, they may be willing to set up a one-off matching gift program and only match donations to your organization.

- Improved Donor Retention: Donors who participate in matching gift programs are more likely to feel their contributions are valuable and may be more inclined to donate again in the future.

Best of all, companies are being more generous with matching gifts. Our research on corporate philanthropy trends found that more companies are matching donations at higher rates, lowering minimum donation amounts, and increasing maximum donation amount requirements. That means higher employee participation and more dollars for your nonprofit!

Benefits of Matching Gift Programs For Companies

Corporate giving is intended to be mutually beneficial. By understanding how these programs also impact companies, you can advocate for them when approaching your corporate partners. Here are some of the enticing reasons companies launch these programs:

- Better Corporate Image: Companies can improve their trust with consumers and employees by demonstrating a commitment to social responsibility.

- More Satisfied Employees: Workplace giving programs like corporate matching gifts show that a company cares about its employees’ values. Employees will be more likely to donate and contribute to a culture of giving within the company.

- Talent Acquisition: 77% of employees reported that “a sense of purpose” was part of the reason they selected their current employer. What’s more, 2 out of every 3 young employees won’t take a job at a company with poor CSR practices, so programs like matching gifts can help attract talent.

- Tax Benefits: Contributions made through matching gift programs are often tax-deductible, providing financial incentives for the company.

From improved brand reputation to happier employees, matching gift programs have many positive implications for companies. Nonprofits Source’s corporate giving trends article shares that many companies are developing year-round strategies as a way to experience these benefits and make an enduring difference!

How Nonprofits Can Identify Matching Gift Opportunities

It all starts with spreading the word. Educate your donors about matching gifts by urging them to check their eligibility in all fundraising appeals, sending informative matching gift letters, featuring matching gifts on your ‘Ways to Give’ page, and posting about matching gifts on social media. You can even have your corporate partners promote matching gifts to their employees!

As we mentioned, a matching gift database is your best bet for identifying match-eligible donors. For example, the Double the Donation database puts the most up-to-date forms, guidelines, and instructions at your fingertips. It covers 99.68% of matching gift-eligible donors, which is more than 26.8 million individuals.

Easily embed our search tool into your donation form, a dedicated matching gift page, your Ways to Give page, and post-donation emails. That way, donors can search for their employers and determine their eligibility during key parts of their journey.

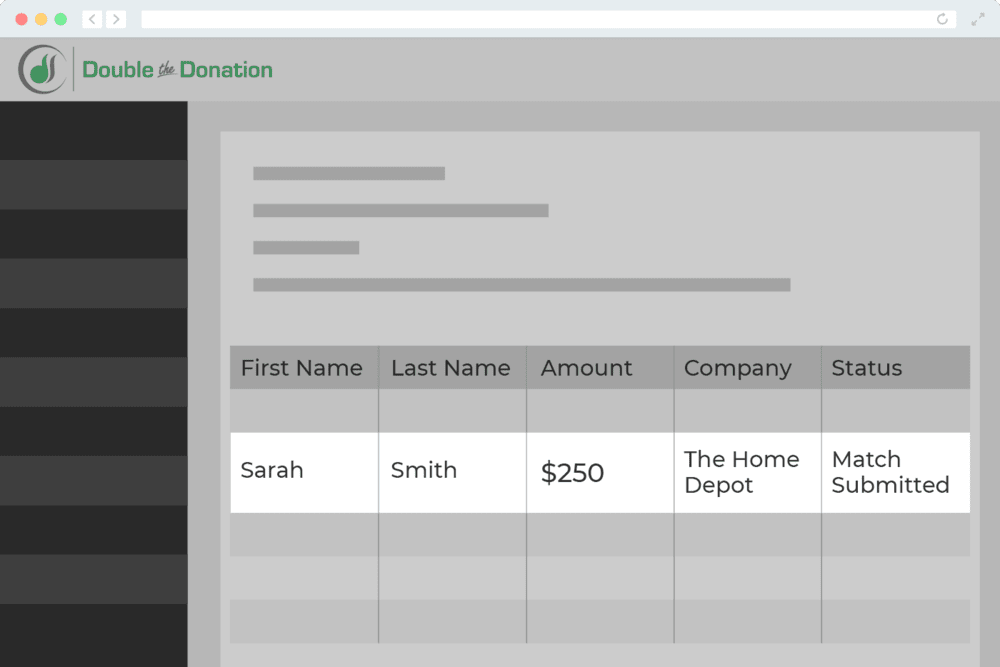

Our matching gift software automates the process of finding matching gift donors, so you can monitor match status and follow up automatically on all opportunities.

Create custom emails that follow up with donors based on their eligibility for corporate matching gifts. For instance, match-eligible donors will be prompted to submit their matching gift requests to their employer. Meanwhile, donors with unknown match status may be prompted to research their eligibility.

Examples of Matching Gift Programs

Here are several examples of matching gift programs that’ll give you a sense of how different these programs can be across different companies:

- Google offers multiple matching gift programs to employees and board members. It will match up to $10,000 in general personal donations annually per employee and an additional $10,000 annually toward disaster relief at a 1:1 ratio. Google also offers fundraising matches, in which it will match the funds employees raise for charitable events. Requests must be submitted by January 31st of the year following the date of the donation.

- Checkr will match contributions from full-time and part-time employees starting at $1. The maximum amount depends on the campaign, and most 501(c)(3) organizations are eligible.

- General Electric matches employees’ donations from $25 to $5,000 dollar-for-dollar annually. Most nonprofits are eligible, and matching gifts must be registered by April 15th of the year following the donation date.

- Soros Fund Management will only match full-time employees’ charitable contributions between $25 and $100,000 annually. The match ratio varies and goes up to 2:1. The donor must request the matching gift within one year of the donation.

- GAP offers matches from $10 to a notable $15,000 per year at a 1:1 ratio. Full-time, part-time, and retired employees from the GAP and its subsidiaries are eligible, but maximum matching gift amounts vary by position.

- CarMax matches gifts between $25 to $5,000 at a 1:1 ratio. Full-time, part-time, and retired employees are all eligible. CarMax also matches gifts from dependents up to age 26.

- Choice Hotels matches employee donations between $25 to $1,500 at a 1:1 ratio. Both full-time and part-time corporate employees are eligible.

- Capital Group matches donations between $25 to $5,000 at a generous 2:1 rate. Full- and part-time employees are eligible, and retirees are eligible for their first two years after retiring!

- The Coca-Cola Company provides a generous 2:1 match ratio for donations between $25 and $10,000. That equates to a maximum $20,000 Coke contribution. Only full-time and retired employees are eligible, and match requests must be completed by February 28th of the calendar year after the gift is made.

Every company’s matching gift program is different, which shows why nonprofits should use matching gift software to locate companies’ guidelines.

Other Resources to Explore

Nonprofit Basics – Learn more nonprofit management essentials by exploring other expert resources.

The Expert’s Guide to Corporate Matching Gift Programs – From common nonprofit eligibility requirements to the submission process, discover everything you need to know about matching gift programs.

How to Win At Corporate Philanthropy: A Nonprofit Guide – Matching gifts are just one piece of the corporate philanthropy puzzle. Explore other top programs and learn how to tap into corporate giving.